I am doing some work after the previous post on tax spend, and here are a few top line results so far. I want to end up with spreadsheet, as Rowan did a couple of years back, where you can enter your income and see the spend.

However income tax is only one of several ways the Government obtains money – with the largest source is rather surprisingly Company Tax. (Source)

I was also surprised at the size of Customs tax, until I saw that 64% of it as GST charged on imports, with the remaining $387 million excise and customs duty. Adding that GST to the main amount would make GST the second largest source of income, and then just by a whisker.

So personal tax, while it affects most of us, is only the third biggest source of tax.

It’s quite different to the USA’s system, where personal income tax is about 50% of the Federal take, Social Security taxes are most of the rest and business taxes are absolutely trivial. The State’s take a bit of tax from business, but across the entire tax system it is only 13%, while income tax is 31%, Social security 22% and property taxes 25%.

I absolutely prefer the NZ system with the tax burden spread relatively evenly across the different sources.

Digging into the department vote (how much is budgeted) and projected revenue numbers was also interesting – here are a few:

The Transport vote attracts a decent swath of revenue – most from Road User Charges and the rest from registrations.

Energy revenue, while relatively small, is mainly from petroleum royalties, with almost all the rest coming from the electricity industry.

The IRD costs 13.5% of the money it raises. That’s higher than I thought.

The Finance vote is offset by a good amount of revenue, but half of that is finance charges to other Departments – for borrowing money I guess. The rest of the revenue is mainly from interest ($538m) and SOE dividends ($466m) along with a big ‘other’ bucket.

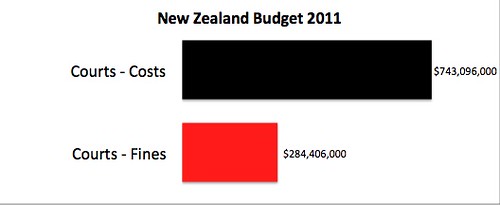

Our courts don’t pay for themselves. Add in $1.4 billion for Corrections and it is a pretty sorry picture. We can do better – and legalising activities like drug consumption would be a start.

More to come in a another post.

This is really interesting Lance. Why cant the govt produce this type of report each year so the average kiwi can understand where our taxes go.

LikeLike

“Our courts don’t pay for themselves. Add in $1.4 billion for Corrections and it is a pretty sorry picture. We can do better – and legalising activities like drug consumption would be a start.”

Why I agree that a drug consumption should not be illegal I don’t think it would reduce the overall cost because you would have to increase health care costs as a result. Or do we simply privatise our healthcare and people pay lower premiums if they don’t consume drugs?

LikeLike

no – you tax the heck out of the drugs and use the revenue to help addicts and on education plans. Just like tobacco and alcohol.

LikeLike

But will taxing the heck out of them actually work? Currently there is black market because they are illegal, and you can make them legal but unless you are undercutting the black market it won’t work.

LikeLike

It’s a matter of getting the levels right. Making it legal reduces the overhead associated with running a criminal enterprise, and also allows you to charge a higher price versus the illegal alternative. That extra margin is tax.

One example is Apple, who with iTunes created an enormous legal market for US$1 songs in the face of an illegal one where the price was $0. That $1 was the price people were willing to pay to be legal and to conduct a transaction in a well-lit market.

LikeLike

We wouldn’t have to increase GST by that much to get rid of company and personal tax alltogether… make GST 50% and we can forget about paying taxes altogether.

LikeLike

Doing this would definetly create a black market for everyday goods and may price neccessities out of reach for those on benfits and students who wouldn’t get any extra money from income tax cuts

LikeLike

So give people in that situation access to a Community Services card which will give them discounts.

It wouldn’t ‘definitely’ create a black market. The biggest issue I see is it’d make purchasing over the Internet more popular making it the final nail in the coffin for book sellers and shoe stores. But that’s inevitable anyway, so not much point in delaying it.

LikeLike

that cant be in dollars?

LikeLike

You look at gst, lottery, alcohol, tobaco, extremely high tax, 40 plus % of the petril we pay, all the money the banks are making especially during the rescission, all the cooperation telecommunication companies and the supermarkets, to mane a few. With what he average person has left they are totally struggling. Its a joke. One wonders how one gets ahead.

LikeLike

Wow. Does the NZ government borrow money?

LikeLike

how can you pay back the intrest on a load when it exceeds the amount you have borrowed lets just say im a country with no money in cylce and i borrow $1billion from the IMF and they want me to pay back $1.2billion were will i get the $200million from if all i have is the $1billion i borowed i cant pay back the intrest so what do i have to do i have to sell my asset to them and thats how many countrys get done over funi that

LikeLike