It’s hard to see how the United States can resume the rapid GDP growth necessary to reduce its fiscal deficit when almost 20 percent of its working population is unemployed or underemployed.

A McKinsey Quarterly report on Globalisation’s Critical Imbalances.

Prepare for large currency shifts between developed and rapid developing countries. If we are lucky these will be gradual, but in the currency game shifts can be sudden and dramatic, the so-called judgment days.

However while I do see a shift in currency is required, I would not bet long term against the US economy – it’s proven time and time again how resilient and powerful it is. That 20% un/underemployment can also be seen as spare capacity in the engine. The USA does have an issue with the lower quartile of population though – generally under-educated and stuck in a horrible poverty cycle. It remains to be seen whether they can turn that into competition for China et al.

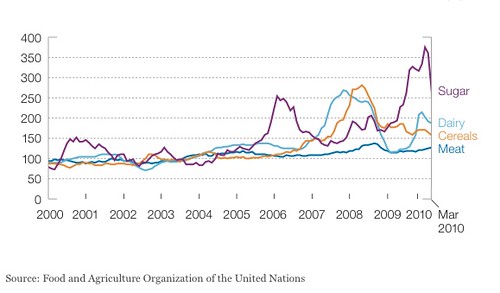

This chart from the report showing food commodity prices shows that dairy prices have risen a lot from their base – but that they have plenty of room to either grow or contract versus historical norms. Mostly contract sadly.

I saw a great comment about the US economy the other day and imparticular about the unemployment figures. Basically it said that the large unemployment figures are where the next round of entrepreneurs will come from. In those statistics, lurking jobless, are the next great creators, the next great innovators. So while the figures seem bad, capitalism has a bunch of little fires burning waiting to take hold. It’ll be interesting to watch and see if this comes true.

LikeLike

But how confident are you Lance that the US government can cure its fiscal problems?

That’s the real issue for the US economy in the long term.

cheers

Bernard

LikeLike

Agreed. But I am confident, but they will bumble their way there. The USG sits on top of that great economy. A lower valued dollar combined with the fundamental underlying strength of that economic engine would be hard to bet against.

That’s not to say that there won’t be horrible economic distortions and unfairness internally – factors that need to be addressed for their long-term social and economic security.

LikeLike