Disclaimer: Punakaiki Fund Limited has lodged a Product Disclosure Statement (PDS) for a Public Offer. Please read the PDS if you are considering an investment.

Yale Investment Office have just announced their latest results (good, especially with the lower risk they carry) and their target asset allocation for 2019.

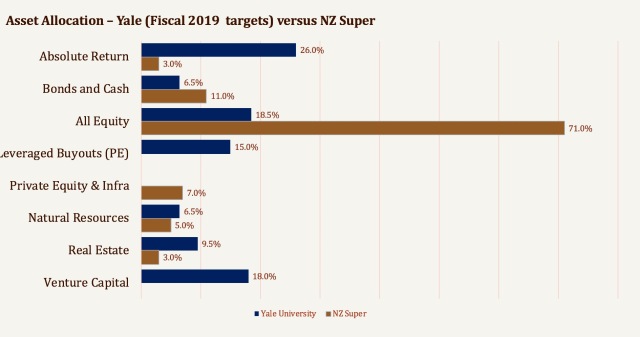

I always find it interesting comparing their portfolio construction to that of our Super Fund. Which portfolio would you prefer to be holding as the stock market wobbles?

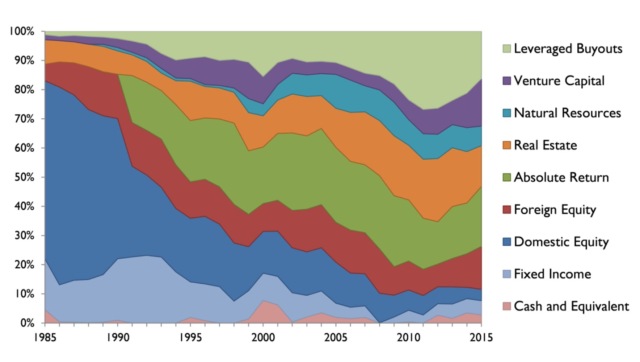

The chart below shows how Yale’s portfolio has evolved. NZ Super has 82% in equites, bonds and cash – a situation that Yale has not seen since 1992 or so.

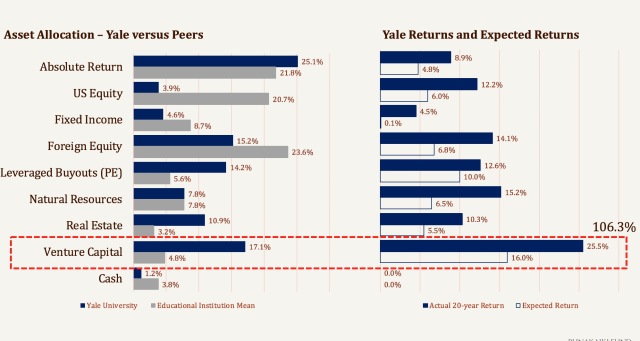

The philosophy differences are astonishing. Yale’s Dave Swensen wrote the book on Institutional Funds Management, and led Yale early into truly diversifying assets – away from US stocks and bonds and into, in particular, alternative assets such as Absolute Return, Venture Capital, Private Equity (Leveraged Buyouts). Their results have been superb, and also resilient to market downturns.

The returns from Venture Capital are particularly strong, as Yale is one of the worlds most desired investors for funds so gets the pick of the crop. Their 20-year weighted return from Venture Capital is 25.5% per year (as any June 2017), and their expected return from Venture Capital going forward is 16%, each of which are the highest across Yale’s asset classes.

It’s highly unlikely that any other investor can do as well as Yale (another peers) investing in Venture Capital, and only the top 10% of Venture Capital funds generate those outsized returns (and Yale has access to them.)

But it still amazes me that New Zealand’s Super Fund allocates essentially none of their portfolio to the class, and that they are so exposed to the stock markets.

Obviously our take is that we, at Punakaiki Fund, are playing in a space that is seriously short of investment funds, that New Zealand has a huge advantage in generating global companies (that need growth capital) and that we could use the funds, and competition, to help those companies.

Excellent summary Lance which highlights how risk the NZ Super strategy is. How and when will institutional investors in NZ diversify into areas like VC?

LikeLike

Hi Lance,

It’s greatly encouraging to hear of a plea for greater personal responsibility for Road Safety to reduce road accidents.

My wife and I have moved to Kerikeri about a year ago. One of my aims is to work towards reducing the numbers and serious nature of road accidents. My plan is to engage with local services, The Police, Regional Councils and Northland District Health Board on ways to initially reduce road speed limits. Kerikeri has a 30kph speed limit in the Town Centre. This coupled with driver education, in particular for teenagers and older people, will move Kerikeri to be one of the safest towns in NZ.

Are there any ideas you have to reduce the road toll and road accidents ?

Cheers,

John

John Eadie

LikeLike