The Internet Society (ISOC) sold the .ORG domain business to a PE firm for US$1.135 billion. There is plenty of coverage of this, and I have been following both Hacker News and InternetNZ threads.

From what I see I believe this was a really bad deal. Bear with me, but this post covers questions we should ask, how the PE firm and their investors are going to make ridiculous returns and some recommendations.

1: Questions we should ask

These are the sorts of questions that are asked for any M&A deal, and listed companies have a heavy burden to answer these and a lot more when proposing deals. Some of these may have been answered, and hopefully they and more will be answered over time.

Was a top M&A law firm retained? (E.g. Skadden Arps)

A great mergers & acqusition law firm would advise the directors/governors of the process to run and their fiduciary obligations. The lawyers would ensure the directors/governors are not liable for the lawsuits that will follow, and would bring in their connections to investment banks and funders who can help. They would ensure that the deals is shopped to other potential acquirers, and that ISOC is in possession of very high quality investment bank advice.

We do not know whether a proper M&A legal firm advised on this deal or who the lawyers themselves were and what experience they had with M&A and finance. It is up to ISOC to provide this information.

Update: “Goldman Sachs & Co LLC. is serving as financial advisor to both the Internet Society and PIR. Morgan, Lewis & Bockius LLP and Proskauer Rose LLP are serving as legal advisors to the Internet Society and PIR, respectively. Macquarie Capital is serving as financial advisor and Morrison & Foerster LLP is serving as legal advisor to Ethos Capital.’”

Was an investment bank retained by ISOC to advice on valuation and options?

A great investment bank (think the biggest Wall St banks) would offer alternative funding strategies, show how the economics work for the PE firm and show the valuation of the company being sold.

Alternative strategies could include raising debt, investing the current funds more wisely, IPOing, finding trade acquirers willing to pay a lot more and, of course, doing nothing. Doing nothing would be, as is becoming highly evident, the easiest course to ensure the stakeholder requirements are met.

A bank may also have advised on better ways to make the governance of the financial aspects of the business work. Heck a consulting firm like McKinsey would have done this for cheap or free – I even did a tiny pro-bono piece of work via McKinsey for a player in this space last century.

But most of all a bank would run a competitive process, so that the price paid is a whole lot higher. They would make commission on this, but the commission could be structured as a % of everything above the offer on the table.

We do not know whether any investment bank advised on the deal and ISOC need to tell us. Normally a bank would brag about this sort of thing (although this is not a deal I would brag about.)

Update: see above and comment below

Was a competitive process run?

A properly run competitive process would have got a lot, tens or hundreds, of PE firms and trade buyers out of the wilderness, as this is, as I show below, a ridiculously good investment for them.

It’s impossible to say how much this would have changed the deal, and we don’t know whether this shopping happened or not.

What we do know is that the eventual buyer was very unusual and that a cursory analysis shows the price looks unusually, highly unusually, low.

We also know that there are much more established well funded PE players out there, and given todays market we can argue that some would surely have considered paying a lot more – perhaps even double or triple. I argue below that at least $1 billion left on the table, perhaps $2 billion.

We do not know if a competitive process was run, and the onus is on ISOC to describe how this deal was done.

Update: we still do not know this

Is the story of how this deal came together published?

I don’t know what I have not yet read, and with 2 little kids at home I have precious little time to search. So perhaps the story is published, and it certainly should be.

Directors of public companies being acquired (or the owner in this case) have a serious fiduciary obligation to retain advice, run processes and then you will see the details of the deal published. “Jo met Tim at a BBQ and ….”

In this case, if this were a listed company, and particularly with the sale to a brand new PE firm started by an insider, there would already be class action lawsuits going on. And they would be winnable.

So we should see evidence of how this deal was conducted in a way that ISOC was able to get the best deal for the society, and that the governers are confident that they are able to defend the deal. If the story is not and will not be published then we are reliant on whistleblowers, and later we are reliant on any lawyers doing discovery.

ISOC should publish a detailed account of how the deal happened, including their own internal process to ensure ISOC got the best deal and did the right thing for stakeholders.

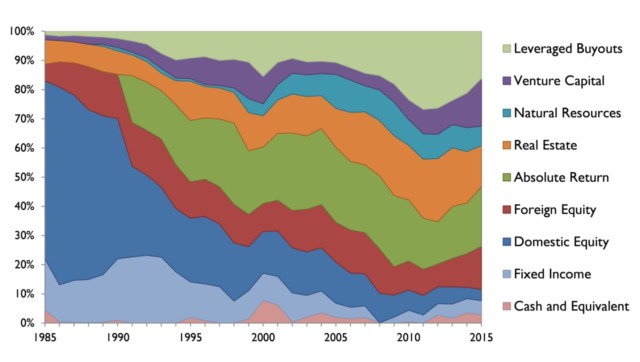

Did ISOC consider other financing instead – such as issuing $500m or $1 Billion in bonds and then investing that in a more diversified portfolio?

ISOC might, if they really wanted funds, instead have raised say $500 million in bonds at a tiny percentage interest. Their recurring income is amazingly solid and has easy ability to grow with price increases.

Meanwhile government bond yields are close to 0%, and even negative in some places, and there is a search for yield by investors. ISOC’s stellar income stream would mean they could get finance at say 2-4% relatively easily, more likely the lower end of that. But even at 6% that means they could have received $500m and only had to pay $30m a year. If they then put their prices up they basically have the same deal benefits as the PE firm. ISOC should then invest the cash in very long term growth funds, delivering much higher returns over time.

We do not know if ISOC explored other options, and they should disclose this and any other advise they received from credible investment banks who do regularly advise on deals over $1 billion.

Was the investment bank incentivized to not do a deal at any cost?

If an investment bank was retained to advise just on on the offer on the table, and they were not incentivised to look elsewhere then the advice was not aligned, and they are incentivised to just make the deal happen.

A correct relationship would see them give stern advice on how to run a proper process and to either run, to to advise on who could run the process. What to look for here is a highly reputable bank taking a percentage fee that increases with larger sale (and a competitive process, with attendant publicity).

All we know is the result – a process that was not public, acquirers who appear to be insiders and a price that seems far too low.

We need to know what actually happened before passing judgement, but the onus is on ISOC to provide this.

Did the deal include the PIR proceeds from 2019 and/or any other cash held?

As above this can make the deal free if the cash in the tin is included in the deal. A good banking adviser would make sure all the cash is taken out at the point of sale, including income in advance. Cash is king.

Again I have had little time to look into this – so perhaps this question is already answered, but it not then ISOC needs to disclose this.

2: Why the price is too low

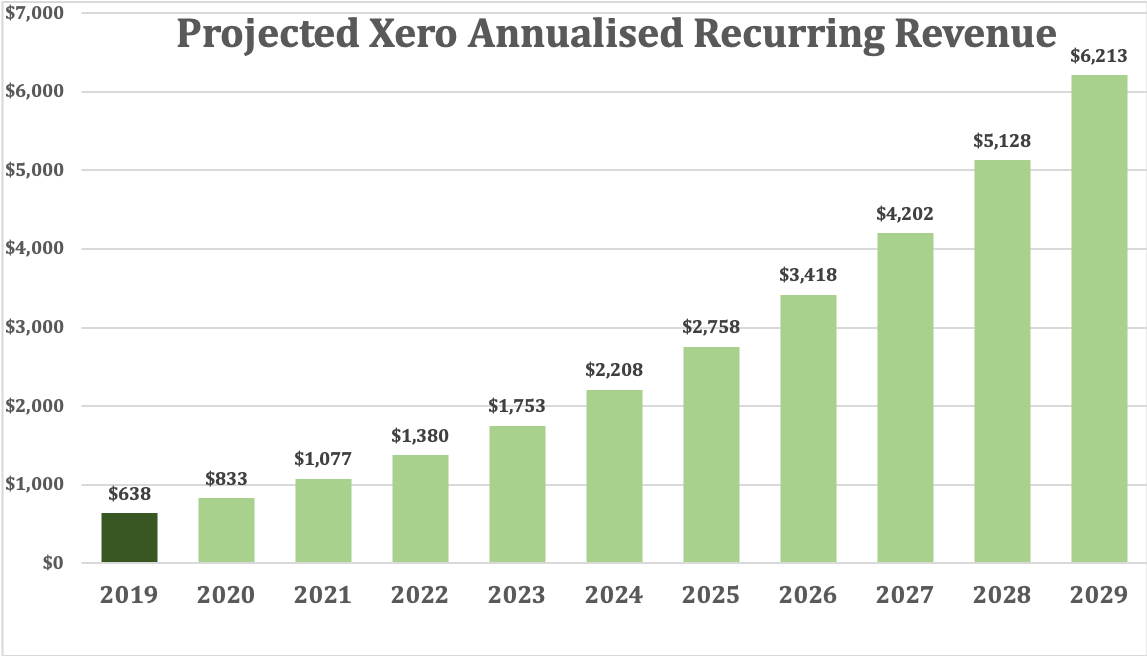

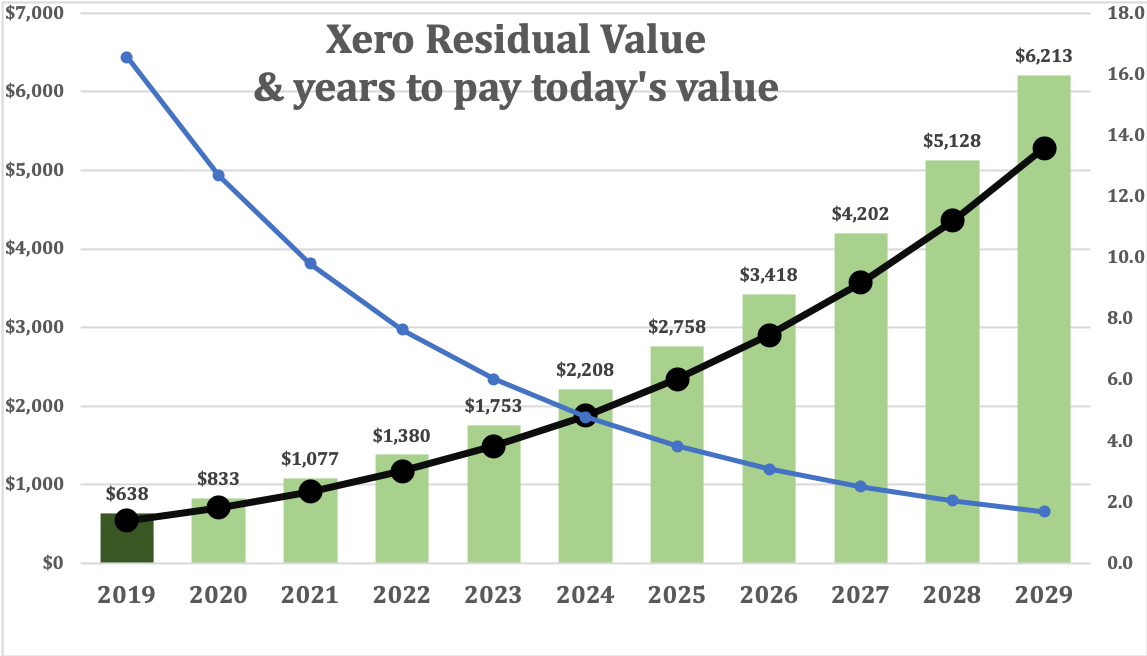

The price of $1.135 billion might sound like a lot of money, but it’s not. Last year ISOC made $44m from PIR, which is a 4% return on $1.135 billion. However the forecast for next year is $55m, so the yield is 4.8%. They sold the company for a bond rate. Let’s work through that.

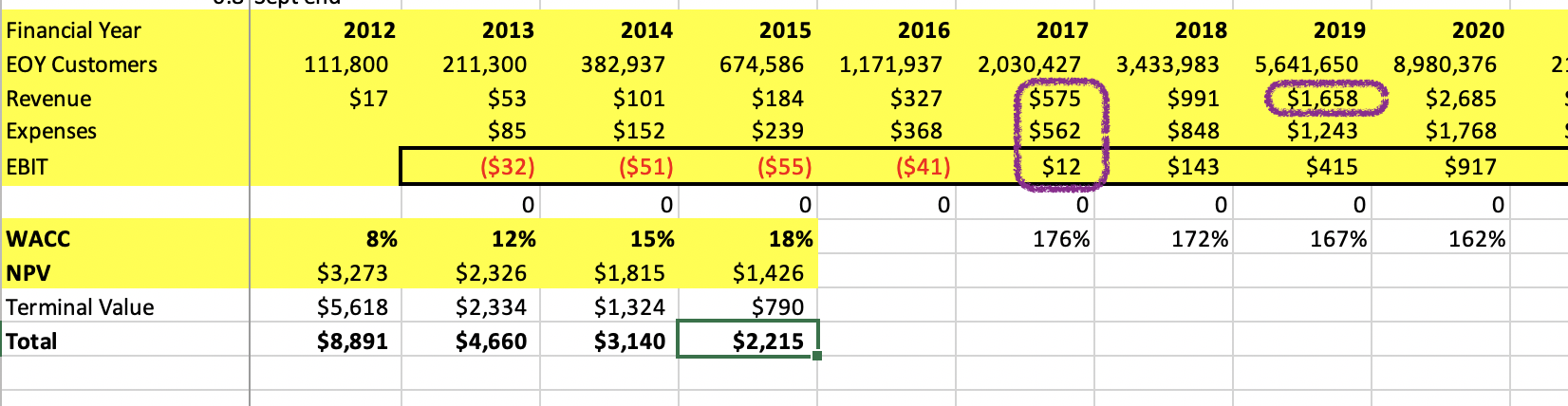

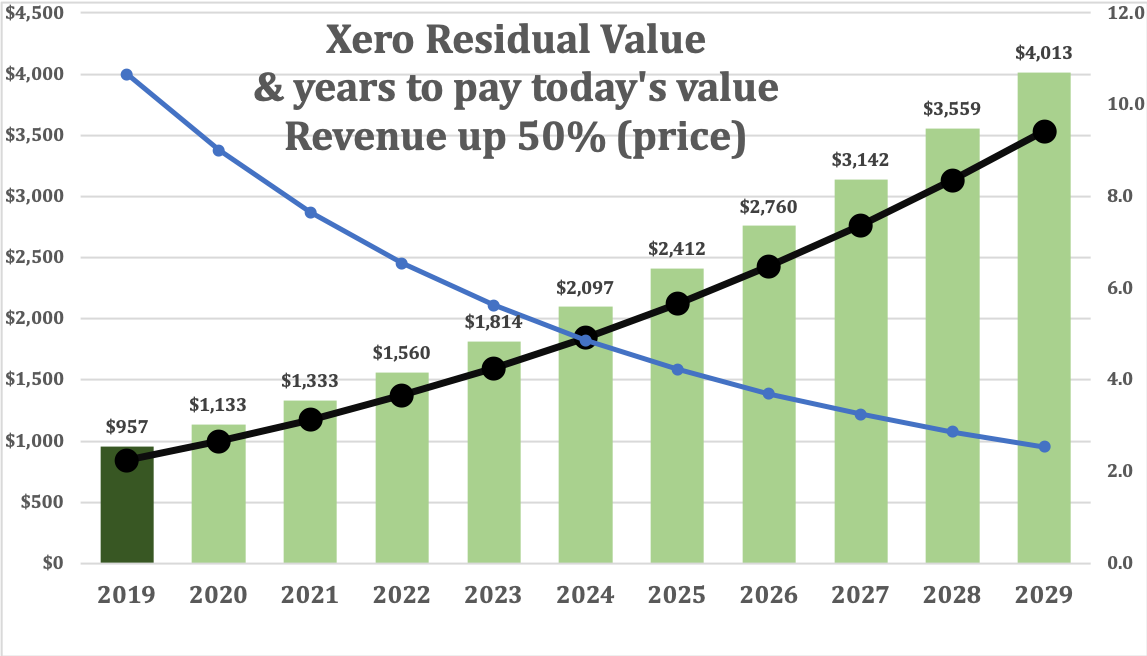

This year PIR was meant to return what looks like $55 million*, and with a 10% annualised profit increase (let’s rise costs at the same rate) the returns would be off the charts.

* https://thenew.org/app/uploads/2019/09/PIR-2018-Annual-Report.pdf)

That sounds ridiculous, but I am serious. The present value of a stream of income is C/(r-g), where C is the income stream, r is the cost of capital and g is the growth rate. So $1 million a year, no growth, at today’s interest rate of say 4% is worth $1/(4/%-0%) = $25 million – conversely you’d need $25m in the bank at 4% to get $1m a year.

In this case C is $55 million, g is 10% (the cap on price increases) and -well let’s look at r.

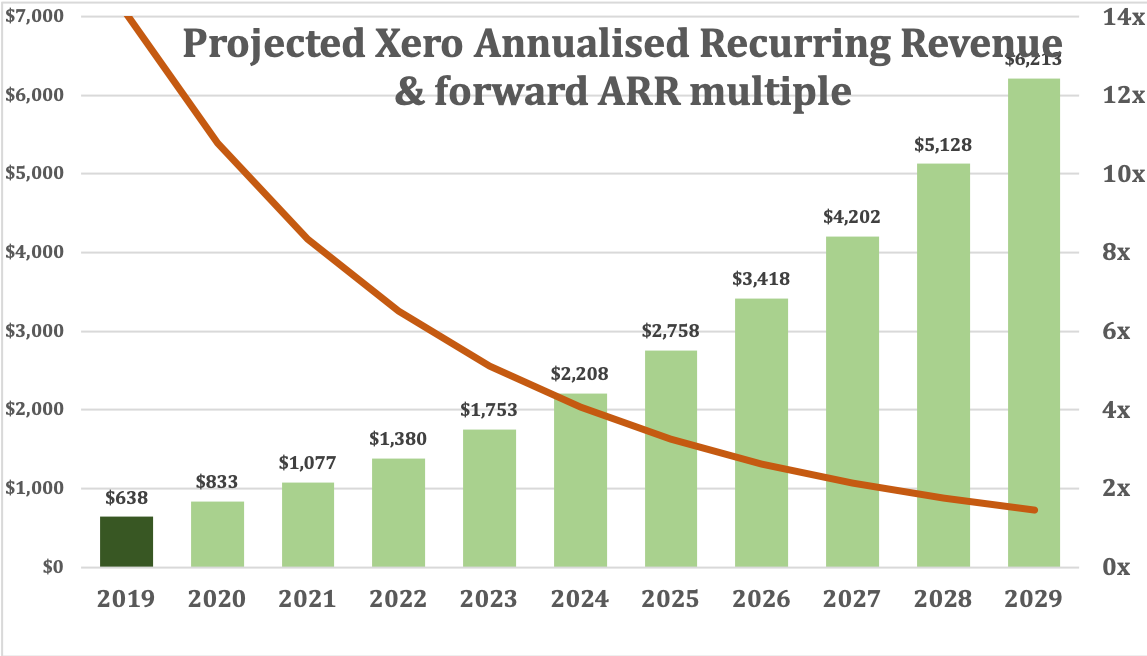

Let’s say the private equity firm wants to make a 20% return, which is pretty normal.

If they financed the whole deal then that makes C/(r-g)= 55/(20%-10%) = $550m. So obviously the private equity (“PE”) firm would not spend $1 billion or more.

But that’s not how PE works. The PE firm is able to finance a considerable part of the deal using senior debt (lowest interest) and mezzanine debt (higher interest). In this case the stream of income is so reliable that the debt lenders would be lining up, and the percentage that could be borrowed would be very high, perhaps over 90%.

But let’s say they could get 80% of the deal priced at an average interest rate of 12%, and the required rate of return for the PE firm is 20%. That would make the weighted interest rate of r = 80%*12%+ 20%*20%= 13.6%. That’s would mean the C/(r-g) formula would be $55m/(13.6%-10%) = $1.53 billion – so the PE firms has $400 million of value on day one.

But that not close to how this works today, as right now interest rates are a whole lot lower than that, with government debt trading at say 2%. They will perhaps be arranging debt financing at 6% or less, but even at a weighted average interest of 8% for the debt the return interest rate, r, would be calculated as 80%*8%+ 20%*20%= 10.4%

That makes C/(r-g) = $55/(10.4%-10%) = $13.75 billion. Obviously that’s a very large difference. But if we use 6%, say, then the equation fails as (r-g) is negative, and that means the returns are off the charts.

So there’s plenty of value here for the buying firm, and very little risk. I see that it’s not unreasonable that the PE firm has put the $13.75 billion valuation deal together.

So that just leaves the PE firm with the problem of finding the remaining 20% of investment (~$230m). If PIR did not pay the ~$55m for 2019 then that will just go straight into paying off short term bridging finance. The 2018 PIR Form 990 showed almost $20 million in cash, $7 million in investments and another $30m which has no explanation. So some of all of that would go straight out to finance the deal. Overall if there were, say, $80m in cash to free up from the company then it’s not unreasonable that all of the rest of the purchase price could be putto debt. In reality I suspect $1-300m is from the PE funders – but they will get that back quickly.

After the acquisition a reasonable PE firm will pay down any bridging finance with any of that cash in the PIR bank (including cash in advance), refinance any high debt with lower priced debt to lower outgoings and then use the ongoing income stream to pay down the more expensive debt first. Obviously they will not just put the wholesale prices up by 10% per year but also pull all the other fees and costs levers hard, certainly resulting in a much greater than 10% profit growth. But even at 10% after 10 years they would be collecting $142 million a year, so you can see how the debt servicing or repayment is not an issue. They could also sell data and so on, no longer being constrained by their owners.

Then they sell that company – making $142 million per year, growing at 10% – that’s obviously worth several billion, and they pay off any remaining debt and pocket the rest. The General Partners from the PE firm who arranged the deal will take 20% of the uplift between the money down from the PE firm ($0-300m say) and the eventual exit price (Say $4-6 billion)

There is much more to this. The debt providers are often the same funding firms or related to the PE firm so they can charge PIR much higher interest rates then the company would normally need to pay, and they and the PE firm make margin there too. (E.g. they could borrow one tranche at 4%, lend to PIR at 8% and without having to do or pay anything make 4% risk free margin, say $20m/year for a $500m slice, plus they would stick the company with a setup fee (2% say) etc.). As the owners they cash do what they like with the balance sheet.

At its worst a PE firm would load up the company with crippling levels of debt & fees, take that money and invest it elsewhere or return to investors. That debt burden on the invested company (PIR in this case might have to pay high amounts of interest each year) can and often does destroy the company, and then the debt-holders own the company outright and they can start again. And so on.

One more thing. I’ve used the 10% growth figure on the dividend stream from PIR to ISOC. Actually the 10% growth rate is applied to the revenue from PIR, which was $93 million in 2018. This increase would come, I suspect, at very little cost in net sales numbers. I’ve also assumed the costs rise at the same rate, but I suspect not only would there essentially be no increases in underlying costs, but the PE firm will work to rapidly reduce costs.

So in reality the forecast ~$55 million paid for 2019 could rise by $9 million (10% of $90m) to in the first year to $64 million, an increase of 16%.

But let’s add, say, $10m in annual costs savings, and that lifts year-1 revenue payout to $74m, and so on.

Over 10 years that $90 million in revenue could be $233 million, less costs of say $53 million (to keep numbers rounded) that’s $180 million a year to put into the pockets of the PE firm and investors.

All these changes increase the Net Present Value and Internal Rate of Returns calculations for the PE firm. I don’t even need to slap a spreadsheet together to show that this is an extraordinarily profitable deal for the PE firm and their investors. It’s a deal of a lifetime – a seller like ISOC doesn’t come along that often.

3: Recommendations

Release the facts

We don’t have all the facts, but when we do have is very disturbing. The first things we need are more facts, and quickly. It looks like at least $1 billion, perhaps a lot more, has been left on the table, and it is up to ISOC to prove otherwise.

Stop the deal and get legal and banking advice

I feel for the directors/governors/councillors of PIR and the Internet Society. This sort of deal is hard even for highly paid and experienced directors of multi-billion dollar listed companies, and they always seek very good advice before stepping anywhere close to a deal.

I want the ISOC and PIR leaders and governors to know that they are likely at great personal risk, and that they should be acting to stop proceedings until they can get the right advice. The right advice and process means that they will then feel comfortable answering the questions asked here, (and also to front up about related party deal details.)

It’s easy to argue that they have been bamboozled, or to be charitable, subject to information asymmetry, but they still have a chance to address that, and they are highly incentivised to do so.

If nothing changes I expect a lawsuit will come out of this, and that’s what ISOC, PIR, and each individual involved should seek really good legal advice before this deal is done. If the suit does eventuate any number of parties may have status to be able to participate in a lawsuit, including members and stakeholders. But it’s a losing situation as a good percentage of the extra money magicked up after a suit is won will go to the lawyers on retainer, and that’s all loss to the Society. Meanwhile all the governors and excecs will be dragged through an expensive and multi-year process that will destroy their own finances and reputations. There are plenty of litigation funding PE firms out there, and I am sure some are looking this over already.

Protect the country domains (.ccTLDs)

It was really good to read comments on the Internet NZ members list from Jordan Carter (CEO) and Jamie Baddeley (President) about InternetNZ’s perspective and legal position with .NZ and ccTLDs that give protection against this sort of deal.

I would encourage every ccTLD Council/governing board to make sure that there are protections against doing something like ISOC. In fact ISOC should do this too.

I would also encourage every ccTLD, and ISOC, to stop leaving money on the table, as InternetNZ has been doing for example by letting the inflation adjusted wholesale .nz prices actually fall each year. InternetNZ and ISOC should ensure that their stakeholders, who are the people of NZ and the world, are prioritised versus domain firms and domainers, who have no problem making extra margin from ever-cheaper prices, or PE firms.

Instead put the prices up, invest funds wisely in diversified portfolios and fund getting more people online and more.

<end>

About Lance Wiggs

For context I am a former councillor of Internet NZ, an ex Mckinsey Consultant based in Washington DC, have advised on the exit of businesses in NZ including a $750m deal. I am currently a New Zealand based micro venture capitalist. I’m also juggling a small family and lots of work, so my apologies if information is already available that I have not uncovered, or if any of the assumptions are wrong. Please let me know and I will correct them, and if you are involved seek legal advice before defending the deal.

This post has been updated for format and grammar.