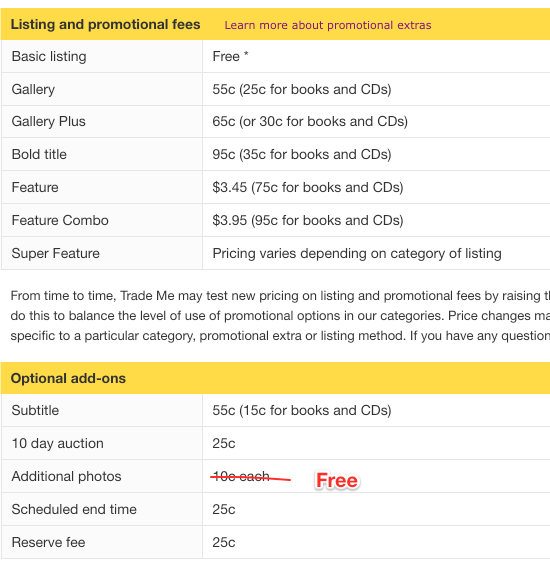

Trade Me has announced that it is changing its auction fees from February 1 – and quite a big change at that. Let’s look at the changes from the old fees to the new.

Listing (Upfront) Fees

Here is Trade Me’s page on the change.

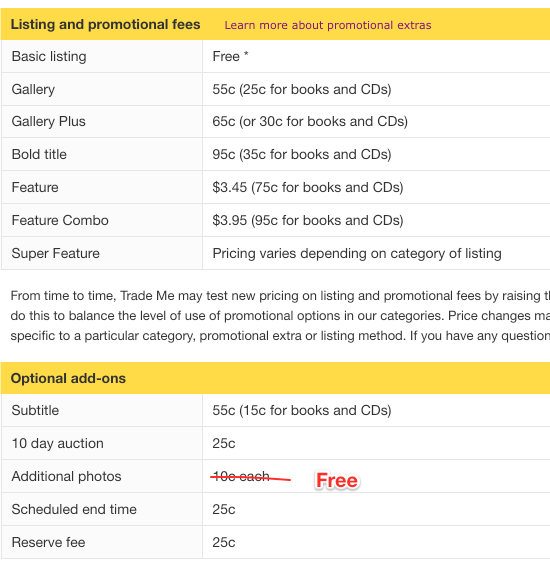

The first change is important – making extra photos free. That’s a great step as more photos per listing means much better listings and therefore a better sell-through rate and more success fees. I am surprised but not shocked given the current policy at the number of listings on Trade Me that have just the single free photo. From research we did 10 years ago we knew that listing with multiple photos are much more likely to sell more, and Trade Me will make a lot more money from increasing the number of items sold and therefore getting their success fees up than a few 10c up front fees. So I expect, and Trade Me wll be a lot les bullish on this, to see the overall sell-through rate to increase substantially – by 10 or 20%, or perhaps more for the affected listings.

This change will improve the marketplace experience for everyone – buyers can see the products better and make more informed bids and sellers can provide a far better story about their product, and only pay if it sells. Overall this will encourage the right behaviour across the general items part of the site, and we can expect to see listings with far more than one or two supporting photos as the norm.

Placing the end user experience first is part of Trade Me’s DNA, and it’s good to see this move. For me it’s a signal that things are changing within Trade Me, and that’s got to be good for everyone.

Success Fees

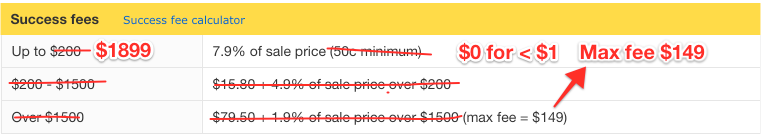

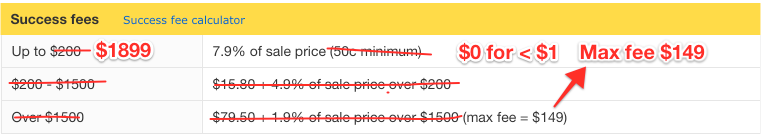

This change has two sides to it – removing or lowering fees for tiny sales prices and sharply increasing the take rate for sales above $200.

Lowering the fees for tiny sales

The minor change is that the minimum fee of $0.50 is disappearing, and also that no fees will be charged for sales under $1. That’s nice, and while it is tiny revenue per item for Trade Me there are a lot of items affected.

The effect of the change then is that for items under $6.39 in sale price the final value fee will drop from a $0.50 flat rate to 7.9% of the price. I am going to guess (and I’m not looking at any historical data to educate that guess) that the bulk of these cheaper sales are at $3-6 anyway, and so the average margin may go from $0.50 to $0.25 or $0.30. Let’s use $0.25 as our estimate, a drop of $0.25 for every listing sold for $6.39 or less.

But given the exorbitant current fees, there are most likely a vast number of listings that are not being placed on the site as the fees are too high versus the sell price. Like the photos change I expect that this will have a very positive effect on the marketplace dynamics, with a much larger number of listings being placed. Trade Me will have to make sure that people don’t try to charge ridiculous shipping fees to compensate, and may need to work fast to manage the potential influx of listings in certain categories. Both are good problems to solve.

So there will be more listings, and therefore more sales, albeit at lower fees per sale. However some of those small item sellers will buy upfront fees, and many of those small items will sell for greater than the seller expects ($1 auctions are almost always worth it).

Trade Me say that 20% of typical sales would experience lower success fees – and those are the ones in this under $6.39 category. I’ll get back to these number later.

I’m going to estimate that the number of listings, and sales, in this category (under $6.39 sale price) will lift by 25%. That’s probably a lot more bullish than Trade Me, but I don’t have report to a stock market. It won’t happen, if it does, instantly, but let’s see how things progress over the year.

Like the photos changes this passes the “is this the right thing to do?” test, which tends to deliver value to members and Trade Me alike. And again another sign that Trade Me is accelerating into the right direction.

Increasing the take rate for larger sales

For a sale prices between $6.39 and $200, which is 74% of listings, there will be no change in their fee. (Mostly – we also need to add sales with a price of more than $5,158, but that’s trivially immaterial.)

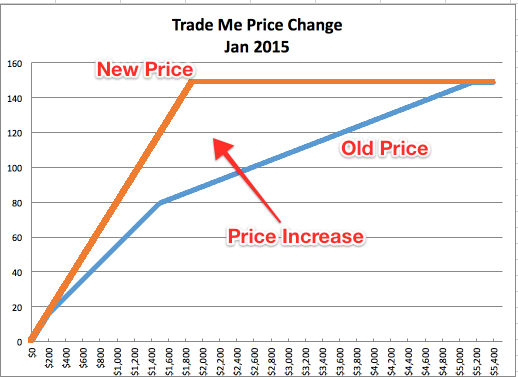

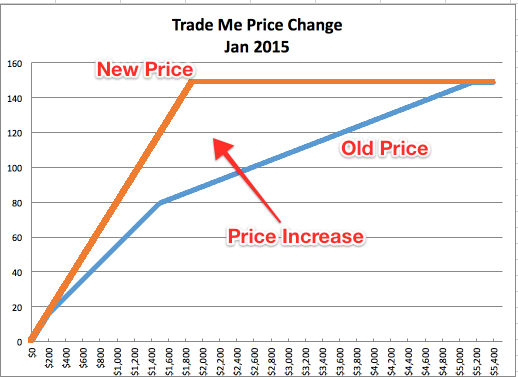

What is material are fees for items that sell for over $200 and less than $5,158, which will see price increases. The best way to describe what is happening is with a chart:

The old price structure lowered the success fee rate in 2 stages as the sale price rose, reaching the $149 maximum fee at a sale price of $5158.

The new price structure does not lower the success fee rate, and so it reaches the maximum fee of $149 at $1,886. At that sale price the seller will pay $149 in fees, whereas before they would have paid $86.82.

I think this change, which simplifies things for everyone, is overdue. Why should sellers of large items pay less commission? After all the same psychology works – if you have just sold something then you don’t mind paying a low commission.

This doesn’t affect the traditional seller of second hand goods, who just wants to maximise price and does not mind paying commission, as long as it is fair. It also shouldn’t affect most sellers of higher value items that they make or source themselves, who should be entertaining healthy margins and who have control of their sale price. However it does affect large sellers who are selling relatively generic or popular goods. For these sellers, who sell things like mobile phones or beds, may be competing with The Warehouse or other websites. A 7.9% margin could be very high, perhaps too high for them to make a profit.

Trade Me already gives large sellers a discount (15%), and the very latest probably have individual deals, which probably (knowing Trade Me’s frugalness) don’t amount to much more. For this change the Trade Me Community has noted that some large sellers are being offered discounts in other areas – such as free Feature listings for a few months. Exactly how this will pay out – I don’t know, but bigger sellers who sell items over $200 will not be very happy.

However bigger sellers, like most on the first page of the Trade Me Stores page, who sell low value items like books will be minting a lot more money. Booksellers will no longer be paying the 50 cent minimum fee, and will be able to put more photos up for free. I expect we won’t hear much from them but they will be very happy with this change.

I also contend that the ecommerce market has changed significantly over the last few years, and that people shopping for the lowest cost generic products may not be looking on Trade Me any more – but on other sites like AliExpress.com. Indeed Trade Me sellers can arbitrage between AliExpress (or even The Warehouse) and Trade Me and make margin – as Trade Me buyers want it cheap, but they also don’t want to fuss with external complexity. Trade Me makes it very easy for kiwis to but and sell – and long may that continue.

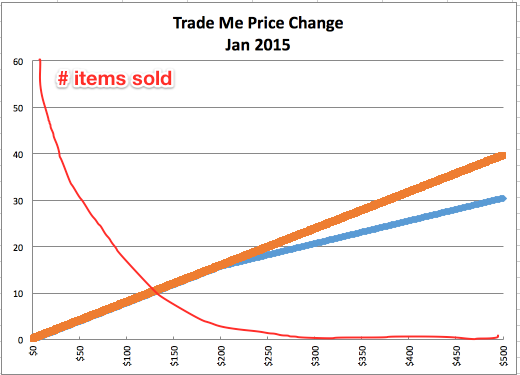

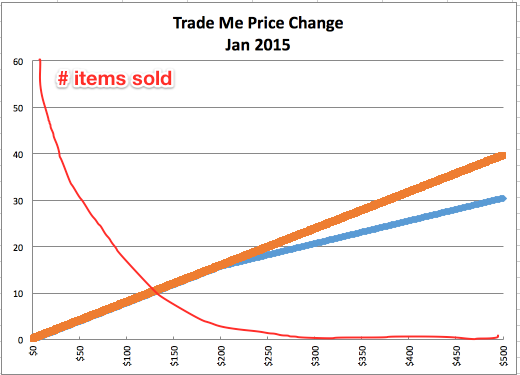

Clearly revenue will increase from this part of the price change, with, Trade Me states, 6% of sales expected to have increased fees. Those sales are priced between $200 and $5,157, but that is deceptive, as the vast majority of sales happen closer to $200. Here’s what it looks like in a zoomed in chart. The red line is drawn by me based on experience not data and is not scientific but looks about right.

While the margin between the old blue and new orange fees in the bigger chart has a straight average increase (the distance between the lines) of $29.50 or so, it’s clear that the weighted average will be a lot lower, so the average may be closer to $2-$7 per listing.

That’s still significant as we shall see. Meanwhile the average listing price is rising, and the number of more expensive (over $200) sales is rising, so we can expect that this sets Trade Me up well for the longer term. Put another way, as inflation lifts prices Trade Me will make more money versus today, much as fixed tax brackets increase average tax paid as wages and salaries rise through them.

I don’t see this affecting volume to much, but there is a risk that some sellers will slow trading. Trade Me will be nervous about that, but ultimately if they can deliver the sales, and they can, then the sellers will stay and probably just pop their prices up slightly to compensate. I expect the community will grumble and then just keep going.

Impact on Revenue – Assumptions

Any model we build on the revenue impact hinges on a few key assumptions, and I will be making some large ones below. Sadly Trade Me does not report that many key metrics – I would like to see them take a more proactive approach as Xero does, and help analysts build their models. The estimates of course have a large margin of error.

Number of new listings: In an interview recently Jon Macdonald stated there were about 300,000 listings per day, which is 110 million general listings per year.

To check that – we know that Trade Me just hit their 1 billionth listing. By searching for listing numbers I found the 826 millionth listing was on Jan 1 2015, and the 1005 millionth listing was a year later. So that’s 179 million listings in a year. That includes motors, property and jobs, which, by my count right now represent about 10% of listings today. So even if we use 150 million listings a year there is a big difference over Jon’s quote. However let’s go with Jon’s 110 million listings a year and put the difference down to automatic new listings created when larger sellers sell many items from the same listing.

Number of listings with paid photos: I’m going with 10%, which in my very cursory scan of Trade Me feels about right. Frankly I could do a much better scan but that takes a lot of time I don’t have. (Someone could use the API to do this perhaps)

Sell through rate (sold listings): The sell through rates vary by product category. For our purposes we are interested in very low value and very high value goods. But let’s start with an overall estimate, because the arithmetic mean of the list – at 12% – is probably not that useful.

Trade Me made $64 million in revenue from general item sales in 2015, which is split between up front fees, premium fees and success fees. If we estimate (and it’s a guess) that $45 million of the $64 million was from success fees, and if we take an average of 7.0% success fee for each sale (another guess), then this implies about 10.7 million items sold, or 9.72% sell through rate. That feels about right.

Low value categories include books, CDs, DVDs and so forth. These sell at very low percentages – just 1% for Fiction and literature, Non Fiction and Children & Babies books. Similarly CDs sell at 4% and Trade Me avoids publishing the results for DVDs.

The question is whether we should use a different sell-through rate for these items, and I believe that we should for the base case, and will choose 5%.

Meanwhile 20% of all items 10.7m items sold are under $6.39, so that’s 2.14 million items a year.

High value categories, between $200 and $1800 include mobile phones, gaming consoles, furniture and a host of other things. Sell through rates for phones are, amazingly, 33%, while consoles hover around 13% for new ones and 5-9% for older ones. Beds and furniture are over 20%, which is amazing as well. But overall let’s recognise that the average for all goods is 10.7% and go with that.

6% of all general item sales are in this category, which means 642,000 items sold a year.

Revenue impact estimates

1: Free Photos

As discussed above I believe that the move to free photos will lift average sell through rates across the board. Even Trade Me would be uncertain about the impact here, but I’m going to be firm that it will left sales across the site by 10%.

That’s a big number – 10% x $60 (average sale price) x 10.7 million is $64 million in extra Gross Merchandise Sales, $5 million in success fee revenue. It’s probably not going to happen at once – but I’d give it a year.

But we also lose money from the photos, which at 10% of 110m listings is 11 million listings. If we assume an average of 2 extra photos for each of these then that’s 11 million x 20 cents, or $2.2 million in lost fees.

So overall let’s say that this will initially lose money, but over time will make over $2.8m extra per year, and I contend that this has significantly higher potential.

The sell through rate is a critical metric – and if items sell more easily then the entire Trade Me engine works better for everyone, and that will create even more listings and sales. There is high potential here.

2: Cheaper low value item success fees

Revenue lost: we will see a loss of, say, 25 cents per item on the 2.14 million items sold in this category, or $535,000. That’s really not a lot.

Revenue gained: I estimated that the number of cheaper listings will rise by 25%, and I also estimate that the sell-through rate for all these listings will increase – as the pricing can be sharper. Let’s estimate that sell through rate will move from from 5% to 6%. The overall effect will therefore increase items sold from 2.14m to 2.94m, which will deliver $735k in new revenue.

These are relatively small numbers, and close enough, so lets call this one neutral overall.

3: More expensive high value item success fees

Revenue gain from single take rate: I see a gain of, say, $5 per item sold in this category, or $5 x 642,000 = $3.2 million. The uncertainty here is that $5 – which I guess Trade Me’s own estimate will be lower. But I really like the potential here as Trade Me is trending towards higher value items.

Overall result

The overall estimated change will be in annual revenue, EBIT and Net Profit before tax – as there are no costs associated with a price change. Adding up the above we see a total of over $5 million per year. I suspect that Trade Me’s own estimate will be closer to $2 million, but I also suspect that over time the actual return will be a lot higher. Let’s see.

A change of $5 million would lift 2015 revenue of $200m by 2.5%, EBITDA of $134.4m by 3.7%, and, most importantly, profit before tax of 111m by 4.5%.

In theory this price increase should lift the value of Trade Me itself by the same as the effect on profit, (4.5%), as these changes in profits will be lasting.

That’s a lot – do I have my numbers right?

Possibly not – do your own calculations and I am not your financial analyst.

- I’ve made mistakes before (when valuing Xero) and would not be surprised to see them again. I am not trading on this and nor do I own Trade Me stock.

- This could be higher. The effect on sell through rate could be a lot higher, the margin between old and new prices for expensive sales could be higher and the estimates of loss of revenue from photos could be overestimated – and so on.

- This could be lower – the photo revenue loss could be a lot higher, the margin between old and new prices lower and the loss of income at the lower end could be worse.

However let’s remember that the price increase was notified to the NZX and ASX markets on Monday, which companies should do when they have a material announcement. So maybe Trade Me is aware of the impact.

The Trade Me share price barely moved in either country, so the market has not really adjusted to this, if it is that material.

In summary

In summary this is a fantastic move by Trade Me. Many sellers, almost all really, will be very happy, and the marketplace itself will use a lot more activity. And then there is that increased revenue.

Let’s leave the last word to suicidemonkey from the Trade Me Community:

“suicidemonkey quoted another poster:

“About time we find an alternative to Trademe. They know they’re the monopoly and they are taking advantage of that. Disgusting.”

suicidemonkey’s Response:

This complaint has been around for at least 10 years. In that time several other sites have started up then eventually folded. Feel free to try again, but the odds are not good for you succeeding.

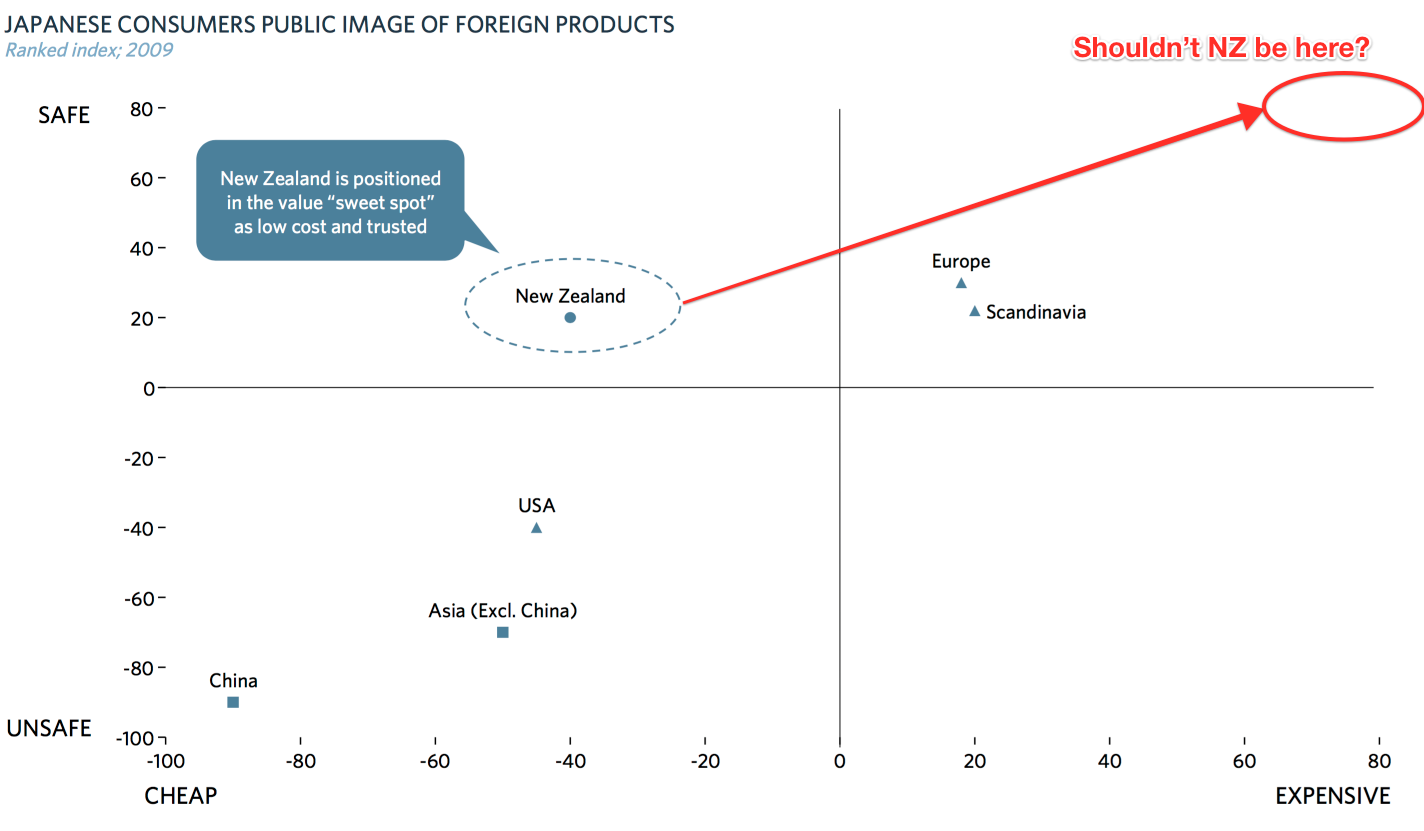

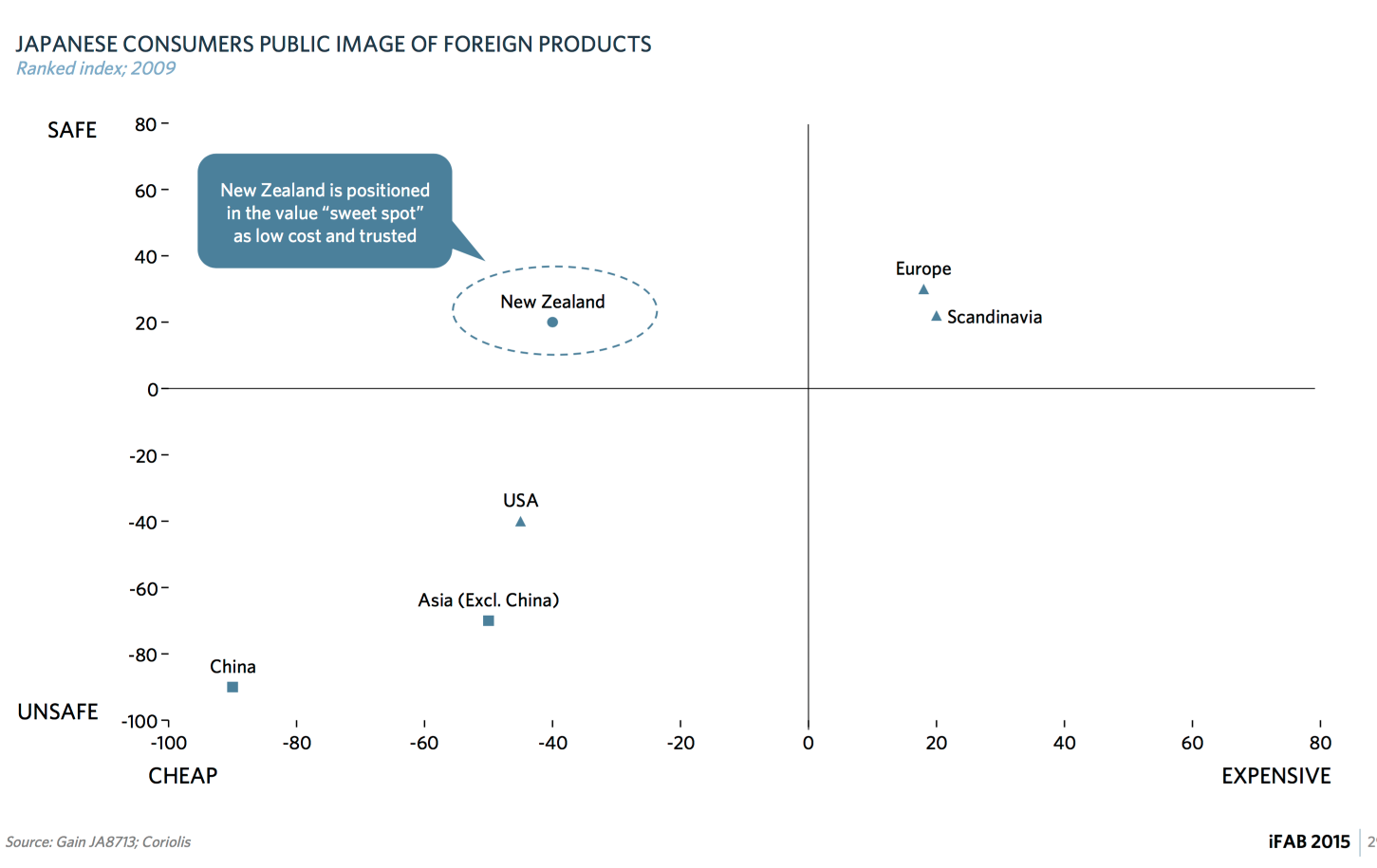

This is a problem but a good one. It shows the opportunity to receive considerable margin by moving to the prestige position.

This is a problem but a good one. It shows the opportunity to receive considerable margin by moving to the prestige position.