Typing away merrily, and my foot nudged a leg of the rather ponderous dining room table that I use(d) for a computer desk here in Fremantle.

It was like a motorcycle crash in slow motion. The legs crumbled away in turn, 30 inch monitor sliding towards the edge and everything moving at once. Coffee cup was empty luckily.

Turns out the legs themselves were joined with one giant wood screw, one could have been loose given the wear pattern and the wood was very brittle. Moreover the center pedestal design has limitations – the table top is heavy and this really should have been supported by 4 legs. (I really should have cleaned that empty box from behind the table. The globe is one of three that lies around.)

Luckily no other damage, and I’m now computing on the kitchen table – which has four steel legs and a steel undercarriage.

Ye Olde Search Engines

For those with long internet memories – here’s what those old search engines looked like back in the day.

Here’s a taste – Google in 1998. It’s amazing how even then they didn’t quite get to the completely barren screen.

And Yahoo! back when the 96 elections where it. I recall watching the election (Clinton won remember) on video over the internet, chatting in a chat room and watching streaming results come in from electorates. It was fantastic – until it all froze the moment after it was clear Clinton had won.

Check out the small advertisement, the links to categories rather than news and the Moose in the logo – they were doing the topical logo stuff well before Google existed.

Internet still reigns as the cheapest ad dollar spend

It’s the big one – the one that moves industries, creates new ones and destroys old ones.

Just how much time are people spending on the internet versus other forms of media? You see when the news finally hits that people are switching off TV, newspapers and magazines and switching on to the internet full time, then the media spend should follow.

Here’s the relevant chart from the World Internet Project – NZ Report:

It has all the information, but does not show it in an easily analysable form.

Luckily the draft report has some tables (no breakdown by demos though), so I am saved from measuring bar length and estimating. Indeed the tables even come with handy means and standard errors.

I simply added up the median hours spent by internet type (home, work etc.), and am comparing them to the other media using median hours again.

Here then is what the media share charts look like for 2007.

or by percentage of media time, for these media only. It’s the same chart, different numbers:

Now – let’s look at media spend by the same categories (excluding billboards, magazines etc.). This is from the Calendar year 2007 ASA stats.

Now we combine them. Here is the amount of money spend by NZ advertisers in millions per year per weekly hour spent on that media by Kiwis. Let’s say that again. Dollars spent per hour consumed. A big number means the market is saturated with expensive advertising, a small number means it is a cheap media for getting to consumers.

Overall – internet is 27 times less monetised per hour than Newspapers, 5.5 times than TV and 2.3 times than radio.

Clearly Internet is the advertisers’ bargain, followed by radio, and they are both going up while the others are suffering a bit. Internet is especially strong for getting to the young an the wealthy, who are the prime targets for many advertisers.

Newspapers take a huge amount in comparison – which clearly is not unsustainable versus TV and radio (it’s been a lot of years) but given the Internet is perceived as an information media, like newspapers, then it should be and is sending shivers up a lot of old media spines.

Four more factoids from the NZ Internet Report

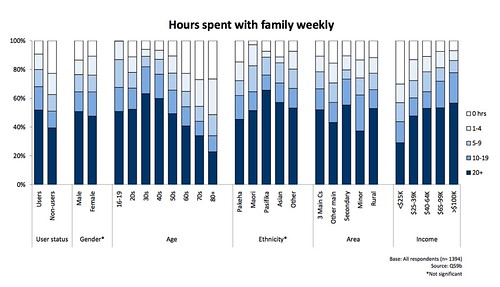

At the bottom of the Wolrd Internet Project – NZ Report are some nice cross tab charts. I find these interesting not just for the internet data, but also for some of the other insights.

1: Wealthier people spend more time with their family, Pakeha spend the least time with family, Males (self reported remember!) spend more time with family than females and internet users spend more time with family than non internet users.

2: 50 -60 year olds know the most – they rely on other people the least for information.

In shock news teenagers, rather than professing to know it all, actually are the ones they depend most on other people for information.

There’s also an interesting reverse correlation between income and this topic – the less you earn, the more important other people are for information.

3: We really need more Maori people blogging. A lot more.

Interestingly lower income people are more likely to blog – is this cause or effect I wonder?

4: While the overall result is pretty much evenly split, the Government funding question (should Govt fund the internet?) shows massive differences by age. When you slice it by age it is clear the young see the value and want the handout, while the old don’t see the value.

It isn’t a rich versus poor thing either – across the income range it is essentially neutral.

Asians really get this one (especially Koreans I would guess), while users versus non-users show surprisingly little difference. This is classic input for politicians who are targeting specific groups with policies.

Top ten findings from the Internet In New Zealand 2007 report

The World Internet Project New Zealand report came out. Worth a look as it is part of a great world-wide project, and will hopefully provide great trends going forward..

Sadly the data is old. Really old in internet time. The WIPNZ survey was conducted in September-October 2007. Why does it take 8 months to analyse it and write a report?

Also the survey excluded those without landlines – like many heavy internet users, and at the bottom end as well.

I would also like to see the actual numbers on charts, and some source data so that we can do our own analysis. But still – great information and we should all be glad to have it.

Here are my top ten factoids from the report.

1: The internet is rated as the most important information source – beating out TV, radio, newspapers and other people. (61% of people rated the internet as important versus 50’s and 40’s for the rest.)

2: While the internet is used for a bunch of stuff, not much actual time per day is spent on searching for information on travel, health, entertainment or employment compared with news and “fact checking” – whatever that is.

3: Asking about reliability of information on the web is like asking about reliability of information you hear from “people” or “in print”. It’s simply a media, and inside the media there are credible and not so credible sources. The way the question was asked was better than most, but a true answer for how much of the information on the internet is reliable would be a very low score, due to the link spammers and so forth.

A better question could be “how much of what you read on the internet is reliable”. So I could conceive myself answering anything from “Little” to “All” on this question, depending upon whether I was thinking about “contents of the internet” or stuff I read on the internet”. So please ignore this chart:

4: The internet is like newspapers, not radio or TV. More about information and less about mindless drivel entertainment.

5: A bunch of us feel more like Kiwis due to the internet. At the very least it hasn’t torn us apart. I for one certainly feel more Kiwi.

Snip. Sorry for those on feeds but I’m putting the rest behind the More… wall to reduce loading time for the page.

Continue reading “Top ten findings from the Internet In New Zealand 2007 report”

Lingopal – the latest

Is Cuil the new Google?

Cuil.com is apparently the new new thing in search engines.

They claim to scan more pages than Google, and they present their results in a lovely, though heavy, format.

In addition to looking at the popularity of a Web page, Cuil also analyzes the concepts on the page and their relationships — grouping similar results under different menus. A Cuil search for “Bruce Springsteen,” for example, pulls up a section for results on the artist and a section for results pertaining to tickets.

But they have failed in Google’s strength – keep it simple and light. Perhaps that is why when I went there before then I got this:

Cuil claim to scan 120 billion pages versus Google’s 40 billion, but Google has just stated that they scan 1 Trillon URLs. Let the battle commence.

Actually it feels a little bit like the Yahoo! to Google era. Yahoo! had increasingly added stuff to their directory and search services over the years – Yahoo! Finance, news, email, personal webpages, shopping, domains and so forth, and as a result Yahoo! had become much heavier. A destination not a searching start point. Google came along, offering an almost blank screen, simplicty and fast loading. Google did not try to own your browsing experience, but merely helped you get to where you wanted.

Now Google is the one with the heavy offerings – iGoogle rather than Google is my default searcher, and then there’s Gmail, maps, news, checkout, groups, blogs, you tube and so on forever.I can stay on Google for hours without going to another site.

So is this a genuine opportunity? Will Cuil be able to be the new simple yet better kid on the block?

It seems that Rowan is involved with Cuil somehow – a Cuil search gives a staggering 21,546,000 results for “Rowan Simpson“, while only 15,651 for former blogger Rod Drury, a pathetic 209 results for “Lance Wiggs” and, entertainingly, none at all for “Sam Morgan”.

(Google gives Rowan 5,530 links, Rod 15,300, me 10,900 and “Sam Morgan” gets 75,500. That seems a lot more reasonable.)

So a bit more work to do there for Cuil it seems. Those 21.5m links for Rowan run out at page 23, a search for “Wellington Blog” gives a useless front page of results and search for “New Zealand blog” gives no results at all. A search for Helen Clark gave the “we are unavaialble” page again.

I remember the early days of Google had their share of being overloaded, but I also remember being absolutely staggered at how much better their search results were than the best competition, AltaVista.

If nobody owns your mortgage note then you are in luck

It seemed like a great idea at the time. Sign folk up to mortgages, sell the mortgages to another financial player who then bundles the mortgage with thousands of others and sells various risk based slices.

It failed in three different ways – two of which we know about, but one which is just emerging.

Firstly the original mortgages were offered to people that couldn’t afford to pay them back, particularly when the so called “fixed” interest rates rose after an initial one or two year period. Much has been written about this (NINJA, Sub Prime etc)

Secondly the riskier slices of the mortgages were vastly under priced, and so the interest rate premium didn’t begin to compensate for the very real probability of a high rate of failure to service the loans.

The third one is a doozy. It turns out that because of the mortgages being sold and sliced and sold, the ownership of the original mortgage is often in doubt. It took Mamie Ruth Palmer in Atlanta, Georgia to bust this one open, in a court case that has just ended a six year saga.

Her bank tried to foreclose on her, but couldn’t prove that they actually owned the mortgage. The bank ended up in the humiliating situation of losing on pretty much all fronts:

Last month she received a settlement from the Bank of New York, the trustee for a vast pool of mortgages that included hers. Under the terms of the deal, the bank reduced Ms. Palmer’s loan balance to $59,000 from about $100,000 and has agreed to accept the proceeds of a reverse mortgage in full satisfaction of her obligation.

The settlement also eliminated about $12,000 in foreclosure fees added to her debt and called for the installation of central air-conditioning in Ms. Palmer’s home.

Roughly $10,000 in legal fees billed over five years by Ms. Palmer’s lawyer, Howard D. Rothbloom, will be covered by payments she has made toward her mortgage while she was battling foreclosure.

Fantastic. Mamie Palmer not only wasn’t humiliated, but she wins a major victory and also gets to keep her home and dignity.

…today, amid the freewheeling packaging of mortgage loans into securities that are sold off to investors, it’s much less clear who controls the note — all of which promises to cause banks enormous legal and financial headaches as foreclosures mount

The problems associated with banks that begin foreclosure proceedings when they do not have proper legal standing are now looming larger in the mortgage meltdown. Loans were heaped into trusts with little documentation of ownership or proper loan assignments — it was all about volume and the fees that came with it — and now that sloppiness is hurting both lenders and borrowers.

Not knowing whom to call is another effect of securitization. In the past, lenders knew their borrowers and vice versa; today the holder of the note securing the property is a faceless investor represented by a trustee, like the Bank of New York.

This all means that the investors that hold mortgage backed securities are less able to get their last recourse of forcing a sale of the house to get their money back. The implications are pretty severe for financiers, and pretty good for homeowners. At the very least it means that the foreclosure costs are going to be a lot higher than anyone previously thought.

Yet another middle man is the company servicing the loan; it has an obligation to the investor to extract all the money it can from the borrower. And because the foreclosure process can generate lucrative fees, servicers have an incentive to drag out the process, experts say.

This is scary – this means that there are agents that have the incentive to screw over both the home owners and the mortgage backed security owners. Not a lot of winners in this one.

Judges are beginning to catch on to all of this.

Arthur M. Schack, a justice on New York State Supreme Court in Brooklyn, is one of the judges who is putting lenders’ feet to the fire. In 14 published foreclosure decisions handed down since Jan. 1, Justice Schack has granted only one lender the right to foreclose. Of the 13 other cases, he dismissed one outright and dismissed 12 without prejudice.

So all in all this is further bad news for the housing trade, for the likes of Citigroup, Freddie and Fannie, but good news for homeowners that are over stretched. But I also have the view that this is good news as it prevents mortgage security holders foreclosing on houses too quickly, and will thus promote alternative courses of action such as renegotiated loans (e.g. for 80% of face value). Renegotiated loans are great where it gives homeowners a chance to pay back a reduced loan rather than declare bankruptcy and walk away from unsustainably high payments.

Immigration – bring us your masses

I’m reading “Immigrants – your county needs them“, by Philippe LeGrain. Fascinating. I’ve been an advocate of open borders for a long time – and I mean truly open, anyone can live where they like (subject to limitations on criminals and the like). So it seems is Philippe and a host of economists.

Turns out that a couple of studies have shown that the economic value to the world of closed immigration policies is insanely high – the latest one, using 1998 data, puts it at US$55 trillion. If you adjust that down to account for barriers that would still remain, it’s still an enormous number.

While the skills based immigration feels right, and works for me personally, the unskilled immigration policies are perhaps more important.

Immigrants are more willing to work harder at lower income jobs – they simply value the jobs more. I recall all the Kiwis and Aussies working in the UK – we would simply outwork out local peers, whether in the back office of a merchant bank, in a pub or in teaching.

It’s changing now, as the immigrants from much poorer places than downunder are taking those pub jobs – immigrants from Poland and other EU countries.

But they are also creating new jobs – it is now posible to get building work done in London for relatively reasonable prices. The labour is all Polish, and English builders are hiring Polish help, while Polish builders have also set up on their own. You can also now get a (often Polish) cleaner for a not unreasonable price, as you have been able to do for years in the USA.The USA is fed by (mainly illegal) migration from Mexico and the rest of Latin America, and becasue igrants are often illegal they are often paid under the table.

In NZ and Australia it is really expensive to get a cleaner, to get your shirts ironed, to get a gardener, cook, pool boy or au pair. It’s expensive becasue we limit immigration of unskilled workers, and it is expensive becasue we insist on minimum wages. Abandon both and all of a sudden we would be able to afford a lot more help at home (as well as builders).

The impact of that is that we would have more time to send with our families, or at work and we would be able to perform higher value work. The example Philippe uses is the investment banker woman who can now work full time. Fast forward and the children of those immigrants are now Kiwis and Aussies, and are hiring more immigrants to help them.

It’s how the USA, Australia and NZ were formed, and we could do well to recall those lessons. NZ and Australia have plenty of room to sustainably grow, and the Philippines (for example) offers a ready pool of educated English speaking folk who would jump at the chance of a chance downunder.

How about it?

The UK example is a good one – tens of thousands of Polish and other poorer EU country immigrants have not stolen jobs from UK workers, but instead created a whole new series of jobs. Previously it was too expensive to pay for British builders to renovate your house, and now Polish workers supply cheap, hard working and effective labour – opening the market.

Portfolio Judgement Day

I was long on Apple when it went up, shorted Citigroup (Citibank) as it went down, and was recovering my portfolio YTD returns to the heights of a month ago.

Then came judgement day. Judgement days do come in stock markets, and more often than people think.

The SEC changed the rules, and banned naked short selling on Fannae Mae, Freddie Mac and a few other financial stocks – including Citibank. This meant that investors couldn’t so easily make bets that share prices were going to go down, and so the share prices went up. My bet on Citigroup was big, and so I lost big. Meanwhile Apple went down on rumours of Steve Job’s health.

It was a pretty low probability few days – two big events affecting the shares that I was most heavily invested in.

So – how was the damage?

In a few days the value of the portfolio dropped from a 28% return for the year to slightly negative (0.4%). That’s a 22% drop. It hurt.

Meanwhile the S&P500 benchmark rose 3%.At least I’m still ahead year to date, but judgement days are harsh on volitile portfolios like mine, and I expect more (though I’d like to be on the right side of them)

Since then I’ve recovered a little, but Citigroup still keeps rising (I still have the put ptions) and Apple recovered a little (I bought some more call options).

I suppose I should be bitter at the SEC for blatantly changing the rules in a bout of corporate protectionism, but for Freddie and Fannie there was always an implicit Government guarantee. No – but I am upset that they also protected Citibank and the other financials. It’s poor economics.

However I’m a firm believer that economics wins in the end – when a stock is lousy then changing a few rules is not going to change the bottom line lousiness. So people will figure out how to short these guys, the price will eventually go down, and judgement day will appear for them. I hope.

Ferrit beaten by who? Torpedo7, that’s who

Nielsen Net Ratings latest press release shows that shopping wannabe Ferrit was third in the online shopping traffic rankings behind 1-day.co.nz. At 2.96% of the weekly unique browsers of Trade Me, and still offering a bunch of shopping categories, Ferrit continues to be irrelevant.

Second placed (but still tiny) 1-day is interesting – they specialize in 1 day sales of sports equipment. Tiny in the scheme of things, but huge in their space.

1-day are part of 4th ranked Torpedo7. Torpedo7 is an Australian NZ (edit – see below) based seller of Bicycle and extreme equipment – and they look like a fun bunch and sell into both countries through .co.nz and .com.au websites.

The Torpedo7 site is simple eCommerce – and it is great to see a specialty retailer show the likes of Ferrit how to do it. We need more businesses like this, much more.

{Update: Thanks to Bruce/bwooce’s comment below. It seems that Torpedo7 is a NZ company. I found more evidence in the shipping information for each site: Australia 5-7 days.

Meanwhile you’ll get your stuff in New Zealand in just 1-3 days. Very cunning disguising of the origin of stuff in the Australia site.}

They had to do it: iPhone blending 3G

One week and a million views old, but worth watching Blendtec‘s iPhone youtube video. They do these to sell blenders, and as advertising campaigns go it is incredibly cheap CPM.

Twitter is suffering, and the scammers don’t help

Are Spammers killing Twitter? Despite constant upgrading, Twitter is more often down than up.

Spammers like this one don’t help – “she” was following over 1000 people when she started following me.

“She” has just one entry. It links to a scam website that sells the concept of Water as a power source for your car. Numpties.

None of this is new of course, but it is sad nonetheless to see a great company like Twitter get hurt by unscrupulous idiots like these.

iPhone and wordpress

well the iPhone is not exactly the simplest mobile platform, but I expect and hope that a wordpress app will arrive soon.

Wroten on my iPhone which luckily corrects almost all of the typos made pm the silly little keyboard.

Vodafone and data warehousing: A translation of that abstract

<cynic mode firmly switched on, with apologies to Rachel>

Via Mauricio, it seems from this, that Vodafone are using data warehousing techniques to drive customer retention. I’ve had a go at interpreting the abstract of “The Customer Retention Journey at Vodafone New Zealand” below. Speaker Rachel Harrison is the Vodafone Lead Analyst who is giving (in Las Vegas) and gave the presentation – she is a SAS and data warehouse pro. Apparently the presentations were made avaialble to Teradata Universe conference atendees – so if you are resourceful then you may be able to find one.

A translation of the abstract

Vodafone is the leading mobile provider in New Zealand (NZ). NZ currently has 2 mobile competitors and over 100 % market penetration.

We are part of another cosy Kiwi duopoly. It’s nice – secure profits for both companies. Isn’t the iPhone cool?! we have the most expensive plans in he world!!

NZ’ders are early adopters of new technologies and our products constantly change and evolve.

But not as fast as other parts of the world which have real competition – see below.

We now have a shift to focusing on Customer Retention.

Because Telecom is shortly going to “compete” with us using current, rather than obsolete, technology. Our collegues in Europe are working on much crunchier problems, which frankly we would like to work on as well. Here’s a quote from collegue Nebahat Donmez : “In highly saturated telecommunications markets with a lot of competition, post-pay consumers revise their contract decisions easily anytime without giving much importance to the brand”.

With the completion of our new Teradata Enterprise Data Warehouse (EDW) we are well on the way in our Customer Retention journey.

We’ve built a big expensive data warehouse, justified on customer retention numbers (a little change means a lot of dollars), but have not done anything with it yet. It’s nice to be in the news for something other than our lousy billing system transtion though. Oh – and this may have been a bit of a corporate manadate as it seems Vodafone use this world-wide.

The new EDW has richer data available to constantly improve our retention programmes.

There is heaps of data in the warehouse and we can’t wait to get going on it.

New products and behaviours flow into the EDW for use in modelling and analysis.

Even more data is being added to the warehouse every day. It’s pretty overwhelming actually.

KXEN has enabled us to develop models quickly to ensure we are constantly including new customer behaviours.

We outsourced a bunch of our work to KXEN, “The data mining automation company” and are still paying them today. It seems Vodafone use them all over the world as well – nice contract.

We now have an iterative modelling process that allows us to keep up with the changing market.

We are a group inside the monolithic Vodafone that analyses and helps retain clusters of people and fee groups. We focus on keeping the ones that give us lots of money and look at things like the intensity of a cusotmer’s calling circle along with credit history. But we are a really smart bunch, and what we really wish is that we were allowed to craft products that deliver what people really want rather than just focus on stopping them from leaving when our policies and procedures piss people off. We can’t, so we do what we can.

SAS has direct against to the EDW and allows us to push queries back to Teradata to speed up analysis.

We can keep using SAS, thankfully, to do our analysis without having to resort to the Tertadata interface that is new.

The retention journey is ongoing; however with our new EDW and toolset we are confident of success.

We have had no results so far. Sorry.

The Warehouse also gave a talk at the Teradata Universe- Ray Renner is the Stock Systems and Process Manager – His Abstract was simply:

Leveraging Teradata Demand Chain Management in a Discount Department Store environment.

much better.