A rare mishap on an Apple site – this the Store.Apple.co.nz site. I would like to buy the new mouse, but when I try to view the cart I get this. Tonight is the second time I have tried.

Alcohol minimum pricing – Reversing the Facts

A PRESS RELEASE FROM MY DAD. Plenty more to come on this topic I feel

Website: www.ffar.org Email: gwiggs@ffar.org

Media Release

Box 776, Noosa Heads Queensland 4567 Australia

ALCOHOL MINIMUM PRICING – Reversing the Facts

The Scottish Government is actively pursuing the introduction of a policy of minimum pricing for alcohol. The proposed minimum price would be 40 pence per unit. The Chief Medical Officer of Health for England also supports a minimum price policy and suggests a minimum of 50 pence per unit but this has been firmly rejected by the Prime Minister.

In Australia the Preventative Health Taskforce (PHT) has recommended the development of “the public interest case for minimum (floor) price of alcohol to discourage harmful consumption and promotes safer consumption.”

In New Zealand the Law Commission favours minimum pricing and says in its report “Earlier this year, Professor Sir Liam Donaldson, the Chief Medical Officer for the United Kingdom [actually England], also recommended that a minimum price model be adopted based on research carried out by The University of Sheffield.”

Both the PHT and Law Commission favour increased price by way higher excise tax.

The rationale adopted by the Chief Medical Officer for England is set out in his Annual Report “There is a clear relationship between price and consumption of alcohol. As price increases consumption decreases, although not equally across all drinkers. Price increases generally reduce heavy drinkers’ consumption by a greater proportion than they reduce moderate drinkers’ consumption.” (Emphasis added) He based this conclusion on the Sheffield University study that was commissioned by the Department of Health. The same argument would apply if price were increased by other means such as higher excise taxes.

A research report by the Centre for Economics and Business Research (CEBR) analysed the University of Sheffield research along with other research. A study by Wagenaar et al (also cited by the PHT and Law Commission) covered much the same ground as the University of Sheffield study on the effect of an increase in price on moderate and heavy drinkers.

The CEBR study found, “Heavier drinkers are generally less responsive to price changes than moderate drinkers, in terms of overall consumption”. In technical terms “The elasticity of -0.21 found in the Sheffield study implies that a 10% general price increase across all alcohol products would only lead to a 2.1% reduction in alcohol consumption amongst heavy drinkers”. On the other hand the Sheffield study found that the elasticity of moderate drinkers is -0.47 which would be a 4.7% reduction in consumption. The Wagenaar study had similar results. The CEBR study prepared the following graph showing the two studies and clearly illustrates that the consumption reduction by moderate drinkers will be more than twice the rate of heavy drinkers.

So how could the Chief Medical Officer of Health justify the claim that price increases will reduce consumption by heavy drinkers by a greater proportion than moderate drinkers when the opposite is the case? It seem that the University of Sheffield data was misinterpreted. As CEBR observe, “Unfortunately this evidence appears to have been misinterpreted by the proponents of minimum pricing, including the Chief Medical Officer of Health.”

This misinterpretation has had far reaching consequences with the Law Commission repeating the error, as has the PHT to a lesser degree.

The evidence is crystal clear. Increased pricing will have minimal effect on reducing consumption of the heavy drinker but far greater impact on the moderate drinker. Policy should be evidence based – not based on factual error.

Glen Wiggs Director

Foundation for Advertising Research

Adjunct Professor of Advertising Regulation

University of the Sunshine Coast, Queensland

16 October 2009

Why not switch to the BNZ Global Plus Cards?

Technebish and Adam suggest I switch to that I switch to the Global Plus Platinum Card.

Here, straight from the BNZ website, is the comparison table between the Global Plus, Platinum (mine) and GlobalPlus Platinum cards.

They all show Air New Zealand AirPoint Conversion.

Why would the other two stay if the one in the middle is going?

An open letter to Air New Zealand

Dear Air New Zealand

Why are you walking away from the revenue provided by people with bank rewards programs – and stopping conversion to Air New Zealand Airpoints Dollars?

I refer of course to the recent notification by BNZ and other banks that they will no longer support Airpoint Dollar conversion.

It puzzles me I admit – as it would seem to me that the program would be 100% electronic and cheap to administer, that the extra money people place in to their Airpoints accounts would encourage them to buy significantly more flights – with both Airpoint Dollars and cash, and that the effort you have put into making the Airpoints Rewards program as good as it is – well it’s a bit wasted now isn’t it?

It also seems like a bit of a clunker of a move for an organisation that in recent years has been getting everything right. What gives? Are you launching a bank?

Please work it out with your former partners – all we want is our AirPoint Dollars back.

Looking forward to your reply

Lance Wiggs

P.S. BNZ, Westpac, ASB and Amex are still on the hool for their annual fees if this benefit does go away.

An open letter to BNZ Credit Cards

To/BNZ Credit Cards

Wellington,

New Zealand

CC/ a few other folks.

Dear BNZ Credit Cards;

I am very upset.

The other day I opened this message in my BNZ internet banking inbox (good to see the newer website by the way):

In this letter (which I assume you have also sent to my address, which I have not been present at for some time) you state that you are removing the ability for me to convert BNZ reward points into Air New Zealand Airpoints Dollars.

This makes me angry as the only reason I selected, and have stayed with, your range of cards is this very ability. Over the last few years I have found real value in the ability to convert reward points into something of genuine measurable and realizable value. It is a wonderful system.

You state in your letter that I will still be able to convert my Rewards Points into FlyBys. I am not, and nor will ever be, a member of FlyBys. It’s not that I don’t think they are an impressive bunch, it’s just that I don’t want to share my transaction data, and nor do I want the economic deadweight loss associated with applying points to a program where the potential purchases are selected for you. In simple terms the value of my airpoint dollars is known – it is $1 for each $1 reward – while the value of a FlyBys point is a function of my perceived value of the goods on offer – goods that I probably would not purchase with my own money.

As I mentioned – this made me quite annoyed. So I searched on my BNZ internet banking site for the terms and conditions of my credit card. I thought that clicking on the Credit Card and Personal Loans section would be the right thing to do – and so that’s what I did.

As I mentioned – this made me quite annoyed. So I searched on my BNZ internet banking site for the terms and conditions of my credit card. I thought that clicking on the Credit Card and Personal Loans section would be the right thing to do – and so that’s what I did.

I expected (I’m kidding really – it was a forlorn hope) to see a range of options under that heading.

For starters one or two credit card offers that you had selected for me based on my transaction records. I’d simply click the find out more button for the one I liked, follow through a page or three of features, benefits and costs and then click the “accept” button to get my credit card in the mail.

The “need a loan?” section would be aimed at helping me into that new Mercedes or buy the house down the road. Or maybe a Hyundai Getz and a room in Taihape – but you get the idea. Once again it would be a simple process. I’d type in the make, model and VIN number for the car, select the dealer from a list and you would come back with an offer. I’d examine the T’s and C’s and then click accept – and the loan docs would go off to the dealer, and the dealer would drive the car to my place.

Similarly for the house – for that you just need the address, and you’ll calculate the valuation, offer me two to three loan options based on my transaction history, let me accept an offer and then offer to take care of the conveyancing for a flat fee. Then you’d liaise directly with the lawyers, the agents and counterparty to make it all happen. After all you are the ones making all the money out of this deal.

I’d also see, of course, the terms and conditions for all of the loan products that I currently have.

But, and you know this I am sure, all I saw was this:

I can add a cardholder (though that has an * attached to it) but I cannot see anything related to what products I currently have. You’ve also lost an incredible opportunity to offer me tailored products – so my cash and ability to borrow sits idle still.

So I logged out before you dumped me out and went off to your main website. I found the Terms and Conditions fairly easily to your credit, but they were of course all for new card applications. I assumed that they were the same as my existing card, but was a bit perturbed to find that I wasn’t quite as special as I thought I was:

It seems that there is a Limited Edition Platinum Visa Card as well as a BNZ Platinum Visa Card. I guess that I am normal not limited, but because I didn’t know I read them both.

They were identical – as far as I can see. I really did look, but they each referred to the both cards. There was one difference – a smaller font and no page breaks for the regular Platinum card – it felt a bit cheaper frankly.

Regardless, I scanned through the boilerplate to get to the salient facts. First you assert that you can change these terms and conditions at whim – with just two weeks notice. I guess your email was just that.

Next I noted that I can indeed change my reward points into BNZ AirPoints Dollars. That’s good. I’ve never seen an offer for a physical item by the way – but then I throw away almost all my mail, and only open what is left every two or three months.

But wait – further on you assert your right to withdraw from the conversion to Airpoints Dollars at any time:

Any time! That means you could do it now. or tomorrow. Or on the 9th of November, 2009.

So it seems you have yourself covered legally. And it seems I signed a contract that gives you the right to withdraw all of your benefits by merely giving me a notice.

But I’m not writing to you with a legal problem. I’m writing to you because I am struggling to use words and phrases that are acceptable in public. You see I am angry. (I think I said that already).

Fool on me it seems – I did read the contract but given that you could change anything anyway I trusted you to do the right thing in the future. But it seems that you did not.

Meanwhile it seems that your lawyers and accountants have not talked to your marketers. Go check out http://www.bnzplatinum.co.nz/. I’ll wait.

Actually I can’t wait – so let me run you through what I saw when I went there just now. It’s the marketing site for the Platinum card. See the text in bold?

That bold text highlights what you see as the principal benefit of the card – the Platinum Rewards. So let’s click on the Rewards tab and head to the BNZ Platinum Rewards page.

That’s kinda small – so let me zoom in on the bit I’d like you to read.

That’s right – not only are you are pushing the rewards points as the main feature of the card, but you also place the ability to convert your reward points to Air New Zealand Airpoints Dollars at the top of the list in the rewards page. Clearly it is the major benefit of the card, and sure enough, it is the only reason I got this card. I wonder how many others were in the same boat? 90% 95%??

There are other benefits – but they are amusingly bad. It’s probably better for all of us that I don’t raise them.

We are talking about fairness here, and we in New Zealand are famously intolerant of anything that isn’t Fair. So can I ask you to answer these questions for me?

- You are marketing a product for which you are canceling the principle benefit. Why?

Now I will give you credit for fixing the error on the page you get after clicking apply now (you really should fix that ugliness). But who is going to read all that text to figure out that you no longer offer Air New Zealand redemption? Where is, for example, the warning in red that states this is no longer an option?

- You have taken away the major (99% for this customer) benefit away from an expensive product. Seriously – it is expensive. By how much will you be reducing the annual fees?

- You imply that Air New Zealand has changed the game. Does this mean that AirNZ put the prices up for Air Points Dollars? Weren’t they always, well, $1 each? What actually changed? (I know this is really three questions, but bear with me)

- What other credit cards that you market have had the same removal of benefits?

- Are you aware that Platinum cards are the vanilla card of choice in the USA and that people in New Zealand that think Platinum has some kid of prestige are sorely mistaken? (I know I know – just look at the state of their economy)

- Why did you change the design of the previous card – it was almost 10% white, and beautifully discreet. The new one has bubbles

OK – so those last two question not really that important – but I thought I’d take the chance while you were reading this and answering the other ones. You are reading this aren’t you? I hope so. I’d love to hear your replies as well.

I did like this product of yours, and I would be more than happy for you to ignore those questions above (except maybe number 6 :) and simply answer in the affirmative to this question:

Will you please retain the ability for Platinum (and goodness knows who else) cardholders to transfer Platinum Rewards Points to Air New Zealand Airpoints Dollars?

many thanks, and I look forward to your response

Lance Wiggs

P.S. Great job by the North end branch on opening my business banking account in about 12 minutes with a minimum of fuss.

P.P.S. I’d love to hear your side of this too Air New Zealand

The stupid American Express “prove you are you” policy

My phone rings – it’s a blocked call. I answer, and then a pause before I hear:

“Hello Mr. Wiggs

It’s so and so from American Express and this is a courtesy call. Can you please answer a question to prove that you are indeed Lance Wiggs?”

“Umm – can you please first supply me with some information to prove that you are from American Express?”

“I first need to get proof of who you are <paraphrased>”

“But you could be anyone calling and trying to get my information?”

“I first need to get proof of who you are”

“I suspect you are calling because my account is overdue. I paid $xxxx it last night <now that I am back in internet land> – can you tell me at least whether that was enough?”

“I first need to get proof of who you are”

“Bye”

Clearly a frustrating call on both sides – the outbound telemarketing agent was constrained by some obnoxious rules and I was constrained by not wanting to give my details away to a potential scammer, but also not wanting to allow companies to engage in behaviour that could open them up to scammers doing the same.

Issues and how to resolve them

1: The American Express representative could not confirm he was in fact from Amex. He could have been from a bill collection agency, a scammer wanting to social engineer information out of me or indeed from Amex.

- Show the correct caller ID when making calls to current or prospective customers. This could even be mandated

- Tell the people receiving the call exactly who you work for – especially if you are from an agency calling on behalf of another company

- Tell the customer something that American Express only would know to prove your identity

- Abandon the “please prove who you are” piece, but only provide the limited information required by the call without further confirmation

2: My American Express account was overdue, and I did not know by how much. I was out of the country for 2 months, had lousy internet access, did not know my American Express website login/password as I never use the site and rarely use the card

- Send me an email – saying you are overdue by $x and please pay (I assume you have my email address from the website login)

- Send me a text – saying you are overdue by $x and please pay (I know you have my phone number – you used it)

- Both those options are cheaper than a call, but the best thing to do is all three

- Bonus – prove you are human and google me then contact me though Twitter, Facebook, Linked In etc. It really is not that hard these days

3: I used the American Express card to buy my AirNZ round the world tickets instead of my normal BNZ card

- BNZ should increase the limit of my credit card to something representing more than 2 weeks of income. They should do this based on the amount of money flowing through my account and not by requesting proof of earnings.

- BNZ should offer me more than one credit card – e.g. a Visa and a Mastercard – to separate personal and business expenses

- BNZ should be sucking up to me in general given the amount of money that I pay and have with them

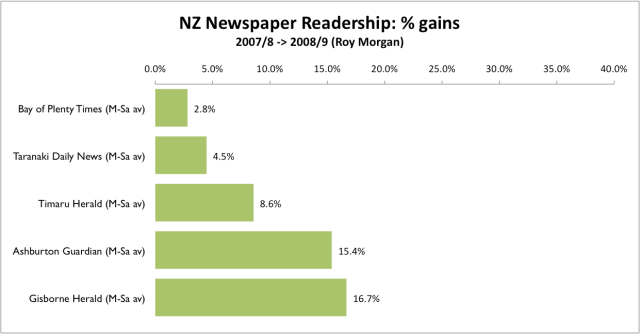

NZ Newspaper Readership Numbers

More Red Sea – this time the changes in circulation numbers for Newspapers. The charts show the difference in readership between 2007/8 and 2008/9.

Once again these are supplied by Roy Morgan. I’ve put the Sundays, which is once-weekly and not a daily average, into the same charts.

Click on the images for larger versions.

See also the Magazine readership charts

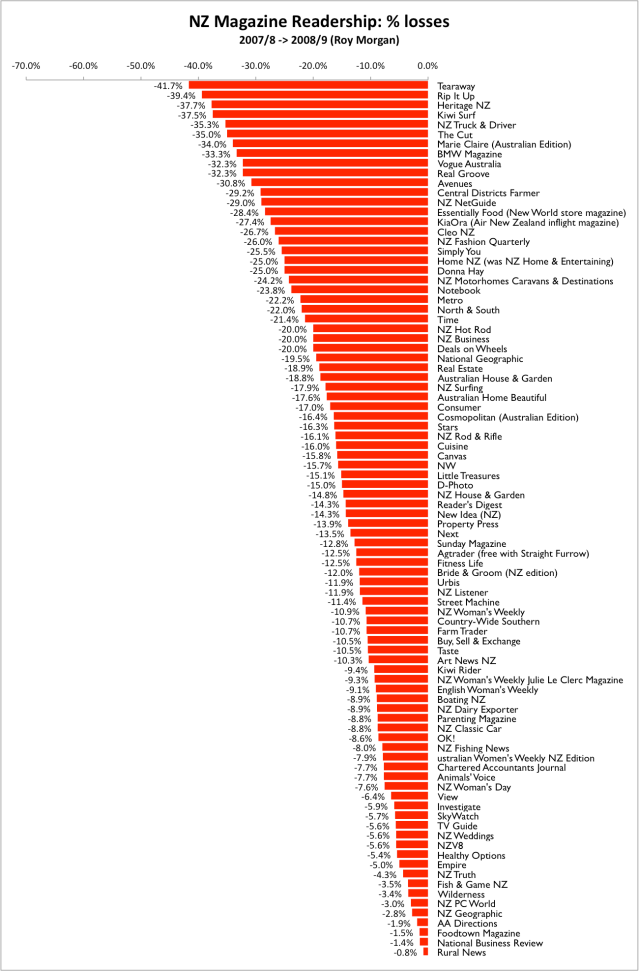

NZ Magazine Readership numbers

The Roy Morgan newspaper and magazine readership numbers are out.

I created some charts to read the Magazine numbers better – so here they are. They show the differences between 2007/8 and 2008/9 readership numbers.

Click on the images for larger versions. Check out the Newspaper readership charts post as well.

It’s a sea of red.

The least remarkable ad campaign

I’m pretty sure MyFarm is unhappy about the placement of their advertisement in NBR’s afternoon update email.

A very clever ad

Those global roaming costs and Kindle in NZ

Amazon.com: Kindle Wireless Reading Device (6" Display, U.S. & International Wireless, Latest Generation): Kindle Store, originally uploaded by LanceWiggs.

I’m glad to hear via NBR that both Vodafone and Telecom are fighting for the rights to deliver Kindle content. That’s good, and I hope for the sake of all of us that they can offer a data roaming price to AT&T that is somewhat less than the current number.

Oh – and while they are at it, how about reducing the data roaming prices for everyone?

Let’s look at the numbers.

AT&T offers international data roaming packages ranging from US$25 for 20 MB up to $200 for 200MB. (That’s $1,250 per GB and $1000 per GB). Those “discount rates” apply to over 90 countries.

Otherwise the casual roaming rate is the even more crippling $19,500 per GB. That’s about the same as Vodafone and Telecom’s.

A Kindle book ranges from a few hundred KB to 2-4 MB, while The Economist averages around 7MB per weekly issue. (You can get books that are much larger, if you are intent on maximising your cost versus price paid ratio.)

At the most discounted rate that would be about $7 per Economist issue, and at the casual rate that’s about $140 per issue. Given that the Kindle subscription for The Economist costs $10 per month, I imagine the bean counters at Amazon would have had something to say.

Indeed they do. US customers will be charged a fee of $1.99 per book or magazine issue for international downloads. Let’s see what that implies for the price Amazon is paying for data roaming.

The average size of the 114 items on my Kindle is 1.35 MB. That implies that the most discounted roaming rate of $1000/GB is a reasonable assumption – giving an average cost to Amazon of US$1.35 per download.

That’s sad – as it also implies that AT&T may not have received superior roaming deals with their roaming partners. It means we are still in the dark ages of global roaming.

However (again), it is interesting to note that while Vodafone NZ is on the list of 90 partners for AT&T’s Global Roaming discount program, we do not yet have a NZ Kindle offering.

Given that, and given that Amazon has yet to select an Australian roaming partner, this means that there is more to the deal than the standard data prices. And there is – Amazon can negotiate a local deal to deliver to local Kindle buyers at much cheaper rates. At the very least they are probably pushing for all you can eat plans, based on the average Kindle user consumption.

So – good luck Vodafone and Telecom, and especially good luck to AT&T. I had hoped that the Kindle could be the catalyst for reducing global roaming charges to something more reasonable – but we will have to wait and see. Well done to Amazon for putting this together tough. The Kindle is an exceptional device, and deserves a global audience.

Now I will go and read the Economist.

Lingopal still big in Japan

Six months on and Lingopal is consistently getting half of our revenue from Japan.

While Europe has a good showing it is really surprising to us how low the US sales are, considering the overwhelming size of the iPhone/iPod touch app market there.

Or perhaps not. US iPhone users probably travel internationally more than the average North American, but they are far less likely to travel versus their international brethren. Meanwhile the US iPhone translation space is very crowded, and perhaps our sense of humour doesn’t relate entirely well to their market.

News from afar – patience required

After the comments in the last post I decided to find some numbers behind the Mozambique experience of Stuff and NZHerald.

Happily the Stuff website eventually came back up. However the experience is less than stellar. My first test shows the home page took 22 seconds to load. Another attempt a few minutes later (done after the first NZHerald test below) showed over 1 minute 20 seconds, thanks to a laggard ad served from Fairfax:

Meanwhile the size of the first homepage was over a megabyte (That’s $10-$30 at going international mobile data roaming rates), while the second attempt was closer to 1.5mb.

The Herald first attempt was very slow – almost a minute, and the second 1.7 minutes. None of this is interactive browsing.

However the NZHerald page was a lot smaller than Stuff’s – at 605kb, and it was the same size the second time as well. It helped that their advertisements were static jpgs, versus Stuff that showed video or flash.

The total bandwidth used for loading both homepages twice was about 4 Mb – or $40-$120 in Mobile roaming charges.

I’m using the (very unreliable) wifi in the hotel – and so there is no imminent bankruptcy. Regardless, I have found that reading news websites from Mozambique is a patience exercise – and one that I have almost always failed.

As an aside – the repeat story on the NZHerald home page was amusing this NZ morning. Seems the story was in two categories, and made it to the front page in each. That should not be able to happen.

Is Stuff cut off from the world?

For the last few days I’ve failed to get anything from Stuff.co.nz. Sure I am in Mozambique but NZHerald and everything else is working just fine, while others in DC and Singapore have hinted at the same problem.

I’ve tried m.stuff.co.nz, and it did work – albeit unusably slowly.

What’s going on? Are others overseas having the same issue?

<update: via @spudooli and Toni and @livlarge: Stuff have run out of international bandwidth.

RT @NZStuff Heavy demand on Stuff has maxed out our international bandwidth and some users having trouble getting in. Increasing limits asap

Words fail me>

USA’s loss of trust in news

Fairfacts confirmed in a post a little while back that his idea of fair is the same as that of Fox News . He did it though while commenting on a particularly interesting series of research. The research is a periodic survey, conducted since 1985 by Pew, on public attitudes to the media.

As always Fairfacts wrote good troll fodder – the best line of which was:

Considering how Fox News is prospering while the MSNBC and the New York Times for example, seem to be paying a particularly high price for their liberal bias, I hope that our own MSM in New Zealand can get the message.

That’s bound to get a rise from many – especially as the very next line was:

..the purpose of the MSM, as paid professionals is to offer fair and balanced news and analysis.

Instead of reading the entertaining yet jingoistic Fairfacts – go instead to the source – Pew’s Research Center for People and the Press – where you will find the original report. It’s fascinating stuff, but to be fair you could interpret the results in a number of ways.

For example:

In 2005, the proportion of Republicans saying news stories are often inaccurate reached a high of 68%: just 47% of Democrats agreed.

Does this mean that the reports from the news organisations actually were inaccurate? (which makes most Republicans right and half of the Democrats right) Or does it mean the reports were accurate and but that the Republicans were a bit less inclined to believe the reports than the Democrats?

Undoubtedly it means both. During the last 10 years we saw from the traditional media plenty of examples of poor journalism (e.g. not not challenging the premise behind Iraq war), an overwhelming amount of biased reporting (Fox) and plenty of one eyed rhetoric (Monica). It’s fair to say that the left and the right were never really communicating, and really still do not to this day. Go follow the health care debate if you want to see what pit of hell political discourse has descended to in the USA.

Regardless of political affiliation, all media, US and otherwise, should be looking at this table with some concern.

Not only do over 60% of people see media news as influenced, biased, inaccurate and one eyed, but a mere 27% see them as professional.

If the big news concerns are not seen as independent and professional, then the value of their authority – their brand if you will – erodes steadily. That brand is out trust in them, and if we do not trust those that bring us the news then why should we bother to watch, listen or read?

We need news organisations that we can trust to find and edit the news – reporting in a truly balanced way. We are lucky in New Zealand with our main media companies – across TV, newspapers and radio we have more than one source of news we can trust. May it continue for a long time.